What’s FASB?

The Financial Accounting Standards Board (FASB), a nonprofit organisation that operates independently, has the power to create and interpret generally accepted accounting principles (GAAP) in the United States for nonprofit, for-profit, and public firms.

A collection of guidelines for how businesses, charitable organisations, and governments should compile and present their financial statements is known as GAAP.

What Is an Accounting Standard?

An accounting standard is a common set of principles, standards, and procedures that define the basis of financial accounting policies and practices.

Understanding Accounting Standards

Accounting standards improve the transparency of financial reporting in all countries. In the United States, the generally accepted accounting principles (GAAP) form the set of accounting standards widely accepted for preparing financial statements.

Accounting standards increase financial reporting’s openness across the board. TThey specify when and how economic events are to be recognized, measured, and displayed. Accounting standards make sure that appropriate information is given about the firm to external entities including banks, investors, and regulatory bodies.These technical pronouncements have ensured transparency in reporting and set the boundaries for financial reporting measures.

As investors, why do we care?

Because the SEC recognizes FASB as the official accounting rule maker for US public companies If companies do not follow GAAP principles, they’re out of compliance, and no respectable Audit firm will certify their financials as correct.

There are two reasons why this announcement is exciting for crypto holder but first it is important to understand how we got here and what the changes mean for bitcoin and cryptocurrency companies.

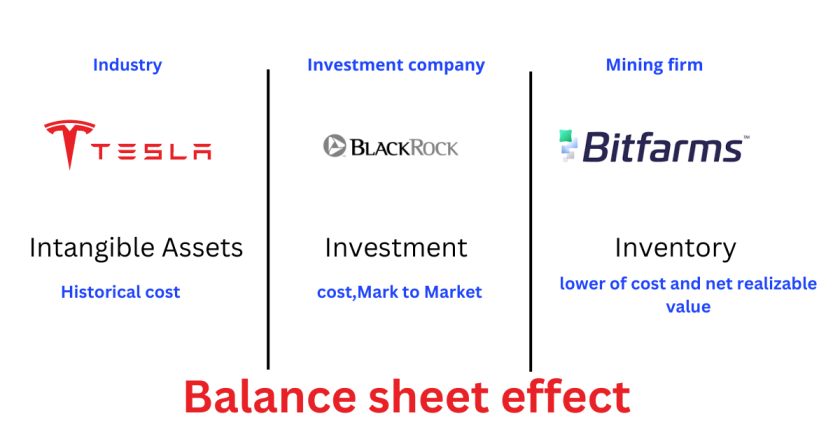

FASB sets the rules for how U.S. companies account for certain transactions. Right now, companies who have bitcoin and other cryptocurrencies on their balance sheet have to account for those digital assets under a rule called ASC 360.

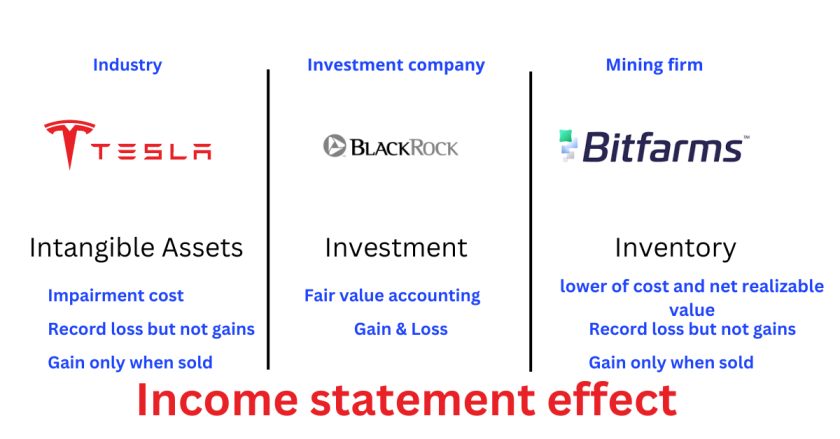

ASC 360 requires cryptocurrencies to be accounted for as intangible assets. Companies and investors have never liked the decision to treat cryptocurrencies as intangible assets because it is not an accurate way to represent the value of crypto on a company’s balance sheet.

The main problem with treating Bitcoin as a intangible asset, is that it’s actually a liquid asset that trades on exchanges globally 24 hours a day, 365 days a year, Bitcoin’s price is continuously updated. Though Bitcoin is not a security, it trades even more often than securities Plus, Gary Gensler, the Chairman of the SEC has stated he considers Bitcoin a commodity It goes to reason, therefore, that Bitcoin should be treated like other tangible commodities, i.e., gold or oil Yet FASB initially decided that Bitcoin should be considered a long-lived intangible asset What this means is that if a company buys Bitcoin, it must list it on its balance sheet at the lower amount of cost or market value.

A public company uses some extra cash to buy $1Billion of Bitcoin, and lists the holding as a Digital Asset on its balance sheet, worth $1Billion Then the Bitcoin price rises 20% In its financials, the company cannot recognize this increase and must maintain Bitcoin at $1Billion. Then, let’s say that Bitcoin falls 50%, and is now worth 60% of where the company bought it In its financials, the company must recognize this decrease as an impairment in value and list its Bitcoin holdings at $600Million, with a $400Million loss. Even if Bitcoin then trades back up, $600Million would remain the carrying value for the company’s balance sheet going forward The only way to recognize price recovery is to sell the Bitcoin and trigger a *capital gain* This is exactly what happened to Tesla.

Under current rules, the fair value of bitcoin is not properly reflected.

But that isn’t the case with other liquid and volatile assets. For example, foreign currencies and other volatile investments qualify for mark-to-market accounting, or fair-value accounting (the point of this post), which allows you to show the fair value of the asset (bitcoin, in CleanSpark’s case), on the balance sheet. Any change–gain or loss—runs through the income statement, giving investors a much more accurate picture of a company’s bitcoin value.

This method, fair value accounting, is the best way to capture the value of crypto assets. It’s something many of us have been asking for.

Now, here are two reasons why I find this change so exciting.

First, investors will now have a more accurate picture of the fair value of a company’s digital assets as the value will be directly stated on the face of the balance sheet. No more digging through press releases or other disclosures to find the non-GAAP measures.

Second, and this is the reason I’m most excited about, is what this change symbolizes. It means that there is significant and growing adoption of crypto and digital assets, to the point that regulators can no longer ignore them anymore. Greater adoption has forced them to address the concerns and economic realities of our changing digital world. This change signals that regulators are finally catching up with innovation. They are realizing that bitcoin and crypto aren’t going anywhere and that more relevant rules for companies and investors alike are in the works.

Well, this accounting barrier has been removed, yes, but FASB still must determine the timing and logistics around the new standard.This is a major milestone on the road to institutional crypto adoption.

Source – www.fasb.org

FASB Board Meeting – Wednesday October 12, 2022 – Topic 2

Naren is a finance graduate who is passionate about cryptocurrency and blockchain technology. He demonstrates his expertise in these subjects by writing for cryptoetf.in. Thanks to his finance background, he is able to write effectively about cryptocurrency.