Fractional reserve banking is a type of banking system where banks keep only a fraction of their total deposits in reserve and lend out the rest to earn interest. This system is widely used by banks all over the world and has a significant impact on the economy.

In this article, we will explain how fractional reserve banking works, its impact on the economy, and its pros and cons.

History

Fractional banking originated during the era of gold trading when goldsmiths realized that not all depositors needed their deposits at the same time. Depositors were given promissory notes in exchange for their silver and gold coins, which were later accepted as a means of exchange. The goldsmiths used the deposits to issue loans and bills at high interest rates in addition to the storage fee.

However, if noteholders lost faith in the goldsmiths, they would withdraw their deposits simultaneously, leading to a bank run and potential insolvency. This risk led to the establishment of central banks by various governments to regulate the banking industry.

Sweden established the first central bank in 1668, and other countries followed suit. Central banks were granted the power to regulate commercial banks, set reserve requirements, and act as a lender of last resort to commercial banks affected by bank runs.

How Fractional Reserve Banking Works

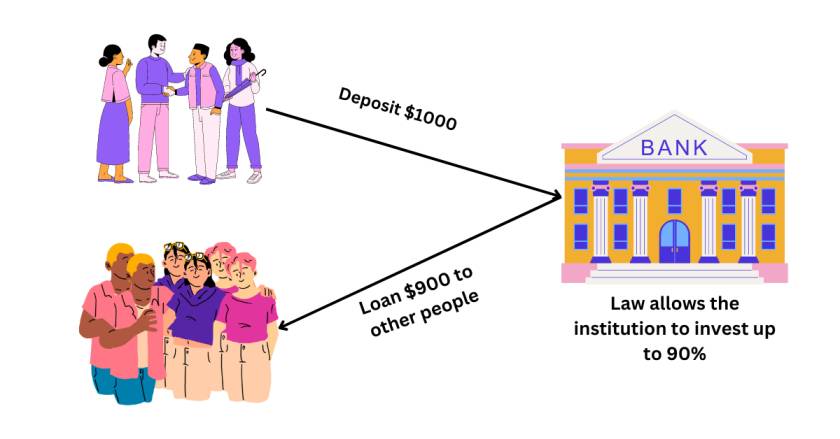

Fractional reserve banking is a system where banks are required to keep only a fraction of their total deposits as reserves. For example, if a bank has $1,000 in deposits, it may be required to keep only $100 in reserve and lend out the remaining $900.

Banks earn interest on the loans they give out and make a profit on the difference between the interest they earn on loans and the interest they pay on deposits. This system allows banks to create money out of thin air by lending out more money than they actually have in reserves.

Steps of Fractional Reserve Banking

Fractional reserve banking is a way for banks to both hold enough cash on hand for day-to-day transactions and expand the total circulation of money in the financial system. Here are the three steps involved in this process:

- People deposit funds: Average people deposit their funds in commercial banks, which serve as depository institutions. Banks offer depositors interest on the money they store in their bank accounts. Instead of letting this money sit idle as vault cash, bankers keep a minimum amount on hand and lend out the rest.

- Banks loan out the money: Borrowers come to banks for loans, and banks use customer deposits to create new money to fund these loans. These loans serve as assets for the bank as long as the bank receives prompt payments from the borrowers. However, if a large number of borrowers were to stop paying back these loans, the loans would become liabilities for the bank.

- Cash reserves accrue over time: As long as the economy remains stable, the fractional reserve system helps both depositors and banks prosper. Depositors earn interest on the money they deposit in the bank, while banks have a greater amount of liquidity. As more and more people deposit their money, banks have more reserve cash to cover any losses and can still lend out more money to other people or companies.

Overall, fractional reserve banking helps banks maintain enough cash reserves to cover their day-to-day transactions while also allowing them to expand the total circulation of money in the financial system. However, it also carries risks of financial instability if borrowers default on their loans, which can cause liabilities for the banks.

The Impact of Fractional Reserve Banking on the Economy

Fractional reserve banking has a significant impact on the economy. By allowing banks to create money out of thin air, it increases the money supply, which can lead to inflation. This is because there is more money in circulation, and if the supply of goods and services does not increase at the same rate, prices will rise.

On the other hand, fractional reserve banking also allows banks to lend more money, which can increase economic activity and stimulate economic growth. By lending money to businesses and consumers, banks enable them to invest in new projects and purchase goods and services, which creates jobs and drives economic growth.

The Money Multiplier

The money multiplier is a concept that explains how fractional reserve banking allows banks to create additional money in the economy. Banks hold a fraction of their depositors’ funds as reserves, while the rest is used for lending and other investments. When a bank receives a deposit, it holds a percentage of that deposit as reserves and lends out the rest. This process continues through the banking system, with each bank holding only a fraction of the deposits as reserves and lending out the rest.

The amount of money that can be created through this process is determined by the reserve requirement set by the central bank. For example, if the reserve requirement is 10%, an initial deposit of $1,000 can eventually create up to $10,000 in new money. The money multiplier effect shows the potential impact of changes in the reserve requirement. If the central bank lowers the reserve requirement, banks will have more funds available for lending, leading to an increase in the money supply and economic growth. Conversely, if the central bank raises the reserve requirement, banks will have less money available for lending, leading to a decrease in the money supply and economic contraction.

Pros and Cons of Fractional Reserve Banking

There are several pros and cons of fractional reserve banking.

Pros:

Allows banks to utilize the money that would otherwise just sit unused.

Banks are able to utilize the money that would otherwise just sit unused through a process called fractional reserve banking. This is a system in which banks are required to keep only a fraction of their total deposits on hand as reserves, while they can lend out the rest of the money to borrowers.

For example, if a bank has $100 in deposits and the reserve requirement is 10%, the bank is required to keep $10 in reserves and can lend out $90 to borrowers. This allows the bank to earn interest on the money that it lends out, while also providing borrowers with access to funds that they may need for various purposes.

Fractional reserve banking can be beneficial for the economy as a whole, as it can increase the amount of money in circulation and stimulate economic growth. However, it also carries certain risks, such as the potential for bank runs if depositors lose confidence in the bank’s ability to meet their withdrawal demands. To mitigate these risks, governments often provide insurance for bank deposits and regulate banks to ensure their safety and soundness.

Increases the money supply, which can stimulate economic growth.

When banks utilize the money that would otherwise just sit unused, it increases the money supply in the economy. This increase in the money supply can stimulate economic growth, as there is more money available for businesses and individuals to invest and spend.

For example, if a bank lends money to a business, the business can use that money to expand operations, hire more employees, or invest in new projects. This, in turn, can create more jobs and stimulate economic activity. Similarly, if an individual takes out a loan to purchase a home or car, that can lead to increased spending and economic growth.

However, increasing the money supply can also lead to inflation if the supply of goods and services in the economy does not keep pace with the increased demand. This is why central banks monitor and regulate the money supply in order to maintain price stability and support sustainable economic growth.

Enables banks to lend more money to businesses and consumers, which can create jobs and drive economic growth.

When banks are able to lend more money to businesses and consumers, it can create opportunities for job creation and drive economic growth.

For example, when a business borrows money from a bank, it can use that money to invest in new projects, hire more employees, or expand its operations. This can lead to increased economic activity, as the business purchases goods and services from other companies, and the newly hired employees have more money to spend in the economy.

Similarly, when consumers are able to obtain loans from banks, they can use that money to make purchases, such as buying a home or a car. This can lead to increased demand for goods and services, which can drive economic growth and create job opportunities.

However, it is important to note that excessive lending by banks can also lead to economic instability and financial crises, as was seen during the 2008 global financial crisis. Therefore, it is important for banks to maintain responsible lending practices and for regulators to monitor the financial system to prevent excesses and ensure stability.

Allows banks to earn interest on loans, which is a source of revenue.

Banks can earn interest on loans, which serves as a source of revenue for them. When banks lend money to borrowers, they charge an interest rate on the loan, which is the cost of borrowing the money. This interest rate is usually higher than the rate at which the bank borrows money from depositors or other sources.

For example, if a bank lends $10,000 to a borrower at an interest rate of 5%, the borrower will need to pay the bank $10,500 back over the course of the loan. The extra $500 is the interest that the bank earns on the loan, which is a source of revenue for the bank.

This revenue can be used by the bank to cover its operating expenses, pay dividends to shareholders, and generate profits. In turn, these profits can be used to further expand the bank’s operations, lend more money, and create new financial products and services for customers.

However, banks need to be careful about the loans they make, as there is always a risk that borrowers may not be able to repay the loan. This is why banks have credit departments that carefully evaluate loan applications and assess the creditworthiness of borrowers before approving loans.

Cons:

Can lead to inflation if the money supply increases faster than the supply of goods and services.

An increase in the money supply can lead to inflation if it outpaces the supply of goods and services in the economy. When there is too much money chasing too few goods, prices tend to rise, as businesses can charge higher prices due to increased demand.

For example, if the money supply increases significantly and people have more money to spend, they may bid up the prices of goods and services, leading to inflation. This can be exacerbated if the supply of goods and services is not able to keep up with the increased demand, leading to shortages and higher prices.

To mitigate the risk of inflation, central banks typically monitor the money supply and adjust interest rates or engage in other monetary policy measures to manage inflation. By increasing interest rates, for example, central banks can reduce the demand for loans and decrease the money supply, helping to stabilize prices.

It is important to note that moderate levels of inflation can be beneficial for the economy, as they can encourage borrowing and investment, which can drive economic growth. However, high levels of inflation can be harmful, as they can erode the value of money and make it more difficult for businesses and consumers to plan for the future.

Can lead to financial instability if there is a run on the bank, and it does not have enough reserves to meet the demand for withdrawals.

An increase in the money supply can lead to financial instability if a bank experiences a run on deposits and does not have enough reserves to meet the demand for withdrawals. When people start withdrawing money from their bank accounts in large numbers, it can create a liquidity crisis for the bank, as it may not have enough cash on hand to meet all of the withdrawal requests.

For example, if a bank has lent out most of its deposits and is left with only a small fraction of reserves, a sudden rush of depositors trying to withdraw their money can create a situation where the bank cannot meet all of the withdrawal requests. This can cause panic among depositors and lead to a run on the bank, which can ultimately result in the bank’s failure.

To prevent this kind of scenario, banks are required to maintain a certain level of reserves relative to their deposits, which helps to ensure that they can meet the demand for withdrawals in normal circumstances. Additionally, banks can obtain liquidity from central banks or other financial institutions if needed to help manage short-term liquidity problems.

In times of financial stress, regulators may also intervene to prevent bank failures and maintain stability in the financial system. This can include providing financial support to troubled banks, restructuring or merging them with stronger institutions, or taking other measures to prevent the spread of financial contagion.

Can lead to a boom and bust cycle as banks lend out more money during economic expansions, and then reduce lending during economic contractions, which can exacerbate the economic cycle.

An increase in the money supply can lead to a boom and bust cycle in the economy, as banks lend out more money during economic expansions, and then reduce lending during economic contractions, which can exacerbate the economic cycle.

During economic expansions, banks may be more willing to lend money to businesses and consumers, as they see opportunities for growth and profits. This can stimulate economic activity and lead to further growth. However, if lending becomes too excessive, it can create bubbles in asset prices, such as housing or stocks, which can eventually burst and lead to a contraction in economic activity.

During economic contractions, banks may become more cautious about lending money, as they seek to manage their risks and maintain their financial stability. This can reduce the amount of money available for businesses and consumers to borrow, which can further exacerbate the economic contraction.

This boom and bust cycle can be damaging to the economy, as it can create instability and volatility. To mitigate the risk of this cycle, banks and regulators need to carefully monitor lending practices and ensure that banks maintain sufficient levels of capital and liquidity to weather economic downturns. Additionally, regulators may implement policies to moderate the economy and prevent excessive risk-taking by banks, such as increasing capital requirements or implementing stricter lending standards.

Conclusion

Fractional reserve banking is a widely used banking system that has a significant impact on the economy. While it allows banks to create money out of thin air and lend more money to businesses and consumers, it can also lead to inflation, financial instability, and a boom and bust cycle.

Naren is a finance graduate who is passionate about cryptocurrency and blockchain technology. He demonstrates his expertise in these subjects by writing for cryptoetf.in. Thanks to his finance background, he is able to write effectively about cryptocurrency.