- Inflation Hedge

- Wealth Protection

- Call Option on a New System

- Detect Capital Controls

- Monetization of Stranded Energy Assets

- Uncorrelated Alpha

- Settlement Network

- Liquid Alternative to Physical Store of Value Assets

- Collateral for Loans

- Bitcoin as a Investment

- Bitcoin censorship Resistant

- Bitcoin Can Be Used for Remittances

- Bitcoin’s role as a treasury reserve

- Bitcoin for Corporations 2022 – Corporate Strategy-Link

- Public Companies that Own Bitcoin

- Private Companies that Own Bitcoin

- Bitcoin As Legal Tender

- Time-Locked Contracts in Bitcoin

- In-game currencies

- Bitcoin NFTs

New technologies often confound us because they don’t seamlessly align with our existing worldview. Instead, they introduce capabilities that were previously beyond our reach and have the power to reshape our behaviors.

This resource serves as a valuable guide for gaining a deeper comprehension of the myriad ways in which Bitcoin can benefit us. It also provides a foundation for contemplating the countless industries, systems, and assets that may face disruption or transformation due to Bitcoin’s influence. In essence, it encourages us to embrace the potential of this groundbreaking technology, which can not only enhance our lives but also challenge established norms across various domains.

Inflation Hedge

In our world, everyday currencies like the dollar or euro are the norm, and governments have the power to create more of this money whenever they want. This practice, known as currency debasement, can be a bit like a sneaky tax that erodes the value of the money we hold. It happens unpredictably, and we tend to just accept it as a part of life.

Now, let’s talk about Bitcoin. It’s a bit of a rebel in the world of money. Imagine it as a digital currency that’s different from what you have in your wallet. Unlike regular money, Bitcoin has a unique rulebook. There’s a strict limit – only 21 million Bitcoins will ever exist, and no one can change that. It’s like having a magical money tree that only produces a fixed number of fruits.

Because of this, Bitcoin doesn’t suffer from the same sneaky tax problem as regular money. You don’t have to worry about governments printing tons of it and reducing its value. It’s more like having a special treasure that keeps its worth over time.

In a world where currency debasement is the norm, Bitcoin offers a breath of fresh air. It’s like a financial superhero protecting your wealth from the erosion that often plagues regular money, making it a compelling choice for those seeking a more stable store of value.

Below image displaying USD to Egyptian Pound performance from the start of the year to the present, as well as BTC to Egyptian Pound performance for the same time frame.

Wealth Protection

Bitcoin functions as a worldwide financial system that doesn’t require approval from anyone, giving individuals the power to transfer their wealth across borders and away from regions or governments where they might be worried about their assets being taken away without warning. This distinctive feature of protecting one’s savings while avoiding oppression or residing under an authoritarian regime empowers the individual. In the long run, it encourages governments that depend on taxes to function more honestly and equitably.

Consider it as having a secret, secure vault for your money that you can access from anywhere on the planet, without needing anyone’s permission. This is especially valuable in places where governments have a history of seizing assets or where citizens face economic uncertainty due to political instability.

The knowledge that individuals can easily move their wealth in and out of a country can push governments to adopt more responsible financial policies and tax systems. It serves as a check on excessive taxation and mismanagement of funds because people have an escape route. In this way, Bitcoin doesn’t just offer financial freedom but also acts as a force for accountability and fairness in government financial practices.

Examples

Let’s say you live in a country where the government has a history of imposing strict capital controls and seizing assets of citizens without warning. You’ve worked hard to save money, but you’re worried about it being confiscated or losing its value due to economic instability. This is where Bitcoin can come to your aid.

You decide to convert a portion of your savings into Bitcoin, a digital currency that operates independently of any government. Now, your wealth is stored securely in the form of digital coins, and you have full control over it. You can access and manage your Bitcoin from anywhere in the world, as long as you have an internet connection.

A few months later, your country’s economic situation worsens, and the government imposes even stricter capital controls. Other citizens are struggling to access their funds, but you, with your Bitcoin, can breathe easier. You have the freedom to move your wealth across borders without anyone’s permission, protecting it from arbitrary confiscation or devaluation.

Knowing that people like you have this financial escape route, the government may reconsider its financial policies. They might choose to implement more responsible taxation and economic measures to retain the trust of their citizens.

In this scenario, Bitcoin empowers individuals to safeguard their savings and encourages governments to act with greater integrity and fairness in their financial practices.

Call Option on a New System

Investing in Bitcoin today is akin to securing a unique position in the realm of digital currency that remains impervious to manipulation or devaluation by any central entity, like a government or a bank. Think of it as owning a share of the most influential digital currency in this emerging era of digital finance, even before it becomes the go-to choice for everyone.

Imagine you’re part of a gold rush in the digital world, and Bitcoin is your shovel. Unlike traditional money, Bitcoin isn’t controlled by any government or bank. It operates on a decentralized system called blockchain, making it immune to the whims of a single authority.

Furthermore, Bitcoin is scarce, like a limited-edition collectible. There will only ever be 21 million Bitcoins, creating a sense of rarity and demand. As more people recognize its value and use it, its price tends to rise.

Investing in Bitcoin means you’re betting on the future of digital finance, where transactions happen seamlessly online, without intermediaries. While it’s not without risks, many believe it has the potential to revolutionize the way we handle money. Just like early investors in the internet reaped enormous rewards, being part of the Bitcoin revolution today could offer similar opportunities in the world of digital currency tomorrow.

Detect Capital Controls

Bitcoin possesses a unique ability that can help us understand how governments manipulate their currencies and control the flow of money across borders. Think of it as a kind of financial detective tool.

Imagine you’re in a foreign country, and you want to know how much your money is worth there. You’d usually check an exchange rate to convert your currency into the local one. Bitcoin can do something similar, but it’s like a supercharged version.

Governments sometimes play tricks with their currencies. They might make it seem like their money is worth more than it really is or restrict how much money can leave or enter their country. Bitcoin can cut through these tricks and give us a more accurate picture.

By analyzing Bitcoin’s value in different places, experts can spot when a country is artificially boosting its currency or limiting money movement. It’s like catching someone red-handed in a game of financial hide-and-seek.

This information is valuable because it helps us see the impact of these tactics on economies. It’s like having a secret tool that reveals the truth behind the scenes of international money games. So, Bitcoin isn’t just digital money; it’s also a kind of financial watchdog that can expose when the rules are being bent or broken.

Monetization of Stranded Energy Assets

The rapid ascent of cryptocurrencies, particularly Bitcoin, has ignited extensive debates regarding their environmental impact. Bitcoin mining, in particular, often faces considerable scrutiny, as critics argue that its energy-intensive process strains electrical grids and results in energy wastage.

However, this perspective is far from accurate. Bitcoin miners actually contribute to the resilience of energy grids, incentivize the development of renewable energy sources, and generate employment opportunities in rural areas. Bitcoin miners are highly adaptable and can be deployed in various locations, responding to grid frequency fluctuations with remarkable precision.

While the energy consumption of mining attracts substantial criticism, it is precisely this aspect of mining that promises the most profound transformative effects. It is essential that we embrace the subtleties of this concept in our discussions with the media, policymakers, elected officials, and the general public.

One of the key advantages of Bitcoin mining lies in its potential to serve as a demand response mechanism for electrical grids. Demand response, also known as “ancillary services” in the Electric Reliability Council of Texas (ERCOT) marketplace (located in Texas), enables grid operators to adjust electricity consumption during peak demand periods, thereby preventing grid instability.

In December 2022, ERCOT reported that 96% of all large flexible loads, which include Bitcoin miners, reduced their energy consumption during a winter weather event when electricity demand for heating homes surged. Nearly 2,000 megawatts of Bitcoin mining temporarily went offline, reducing peak electricity demand by that amount.

Furthermore, by utilizing energy during times of day and in regions with excess or stranded energy, miners can significantly enhance the economics for renewable energy generators like wind, solar, and natural gas plants. This economic boost for generators supports their capacity expansion, effectively leveling out peaks and troughs in energy demand, especially during periods of negligible energy consumption (e.g., overnight).

Former ERCOT Interim CEO Brad Jones aptly noted at the 2022 Texas Blockchain Summit that “Bitcoin mining is a great thing to help us balance the grid. The Bitcoin miners reduce their consumption when prices rise, allowing us to redirect that power to other consumers.”

Bitcoin mining operations inherently require proximity to cost-effective energy sources, many of which are renewable, such as wind farms, hydroelectric power plants, and solar installations. By locating near these sources, miners help stabilize the grid by absorbing surplus electricity production that would otherwise go to waste. Consequently, this reduces the need for grid operators to adjust conventional power plants, minimizing inefficiencies and promoting a cleaner energy mix.

Additionally, Bitcoin mining is driving substantial investments in renewable energy infrastructure. To remain competitive, miners continually seek lower electricity rates, often leading them to regions abundant in renewable energy resources. By establishing mining operations in these areas, miners create revenue streams that encourage further investments in renewable energy projects.

This phenomenon has been observed in several regions where mining operations played a pivotal role in initiating financially viable renewable energy projects. The influx of capital from miners contributes to the expansion of renewable energy installations, ultimately fostering a cleaner and more sustainable energy grid.

The energy-intensive nature of Bitcoin mining has prompted mining companies to actively seek energy-efficient solutions. As competition intensifies and energy costs rise, miners have a strong incentive to develop innovative ways to reduce electricity consumption without compromising mining capabilities. This drive has led to the creation of more energy-efficient hardware and cooling systems.

Moreover, the decentralized nature of Bitcoin mining incentivizes efforts to decentralize energy grids. By promoting distributed energy resources (DERs) like solar panels and home battery systems, Bitcoin mining can facilitate grid independence and resilience. In times of natural disasters or other emergencies, these DERs can continue to operate autonomously, alleviating stress on the centralized grid and ensuring a stable energy supply.

Uncorrelated Alpha

According to Fidelity Digital Assets’ Bitcoin Investment Thesis Report from 2020, the correlation between Bitcoin and other assets during the period from January 2015 to September 2020 averaged at 0.11. This figure suggests that there is virtually no significant relationship between the returns of Bitcoin and those of other assets during that time frame.

Settlement Network

Bitcoin, a decentralized digital currency, operates on a peer-to-peer network, allowing direct transactions without the need for a central authority. Transactions are recorded on the blockchain, a public ledger maintained by a global network of computers. To employ Bitcoin as a settlement network, transaction parties agree on terms, and upon consensus, the transaction is broadcast to the network. A network of nodes validates and adds it to the blockchain, ensuring transparency and immutability. This secure and reliable system has the potential to serve as a global settlement network for banks and businesses, offering advantages like censorship resistance and immunity to central bank inflation. Despite scalability challenges, Bitcoin’s rapid settlement of high-value transactions makes it a compelling choice for financial intermediaries, further fostering its growth as a global settlement network.[Read More]

HIGH-VALUE SETTLEMENT

The bitcoin network enables moving a billion dollars worth of value across the world, securely and in minutes, for less than a few dollars. It’s becoming a more attractive method of final settlement for high-value transactions than traditional financial infrastructure.

MICROPAYMENTS

Bitcoin has a distinct unit of account known as a “sat,” which presently equates to 1/100 of a cent, while one whole Bitcoin (BTC) is valued at $10,000. The term “sats” may already be one of the most widely recognized global units of account for representing values less than one cent.

Liquid Alternative to Physical Store of Value Assets

Many physical store of value assets, such as fine wine, vintage cars, and high-end art, face significant challenges related to storage, maintenance, and authentication. For example, maintaining the proper conditions for storing valuable wine or ensuring the authenticity of a rare artwork can be costly and complex.

In contrast, Bitcoin, as a purely digital asset, does not involve these types of expenses. It offers distinct advantages, including high liquidity and the ability to trade around the clock in a truly global market. This makes Bitcoin an attractive alternative to traditional physical store of value assets.

Collateral for Loans

The credibility of Bitcoin’s scarcity, which can be independently verified through a full node, makes it an excellent choice as collateral in transactions. Currently, there is a significant increase in fiat-denominated lending due to the tax benefits associated with using Bitcoin as collateral. Furthermore, Bitcoin’s programmable features, such as multi-signature custody schemes, introduce an additional layer of flexibility to loan agreements.

Bitcoin as a Investment

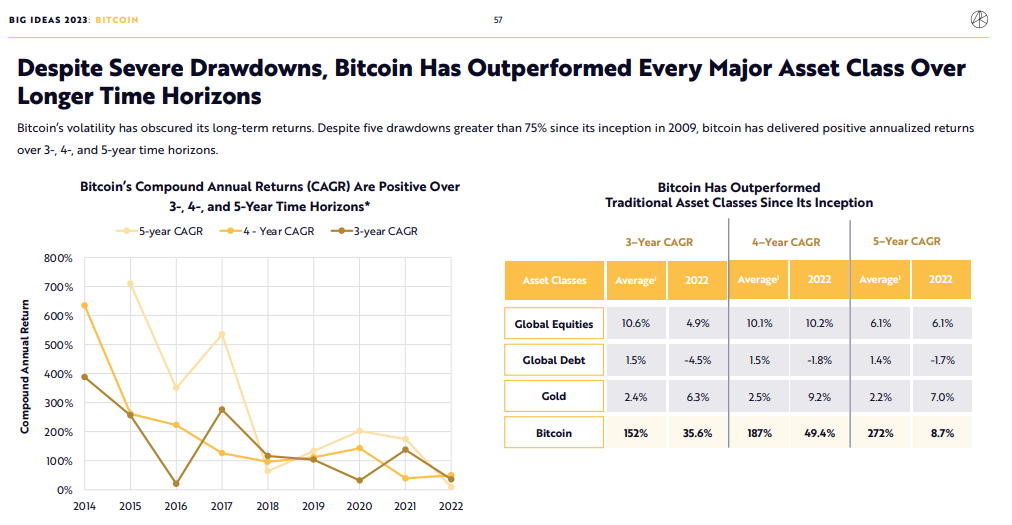

Bitcoin’s remarkable rise over the past decade has demonstrated its potential as an exceptional long-term passive investment strategy. As concerns about liquidity diminish, those responsible for allocating capital are now faced with the task of justifying their active investment strategies if they fail to outperform the straightforward strategy of holding Bitcoin. With a staggering return on investment of 100 million percent over the last decade, investing in Bitcoin appears to be a consistently wise choice. The challenge lies in timing one’s entries and exits to maximize returns in a market characterized by high volatility.

It’s important to acknowledge that Bitcoin can experience significant price drops. Nevertheless, historical data shows that after each market downturn, it has eventually recovered. The challenges in the cryptocurrency space stem from both external and internal factors. If you believe in the long-term viability of cryptocurrencies, Bitcoin is likely to remain at the forefront.

For long-term holders, often referred to as “HODLers,” these periods of market negativity can be seen as opportunities to accumulate more Bitcoin, particularly when trust in the crypto market has been shaken by various scandals. Looking ahead, 2022 will be remembered either as the year when the crypto space resolved its issues or as the year that led to its downfall. Investing in Bitcoin is essentially a bet on the continued expansion of adoption on the network and the integration of cryptocurrencies into everyday transactions.

Considering Bitcoin’s growth and the strong support it enjoys from users, its potential in 2023 remains promising. Additionally, as the fastest-growing cryptocurrency globally, Bitcoin continues to be a significant digital asset and a compelling investment option for the year 2023.

Bitcoin censorship Resistant

Understanding Bitcoin’s decentralization requires recognizing its implications within the ecosystem. Decentralization means the absence of a central authority in the network. It extends to various aspects, including individuals, miners, HODLers, nodes, exchanges, and wallets, each with varying significance.

For Bitcoin, decentralization’s core objective is to provide a currency free from government interference. Node decentralization is crucial; centralized nodes can lead to manipulation or attacks. Recognizing the role of each element in achieving decentralization is vital.

Bitcoin’s journey began with centralization but evolved as more nodes joined. Today, it boasts the highest node decentralization among cryptocurrencies. Nodes store rules and the blockchain, making it difficult to eliminate Bitcoin. This resistance safeguards its scarcity.

Bitcoin faced challenges like the Block Size Wars, highlighting its decentralized nature. Unilateral changes are not part of Bitcoin.

Bitcoin remains leaderless, shielding its decentralization against threats. In contrast, many altcoins have leaders, compromising decentralization. High node operation costs in some altcoins hinder decentralization.

Running a Bitcoin node easily decentralizes mining, thwarting coercion. Bitcoin’s coin distribution is broader due to miners’ need to sell coins.

As Bitcoin’s value grows, large holders may diversify, further distributing coins to new participants. Bitcoin’s decentralized and permissionless nature ensures no entity can exclude participants or censor transactions.[Read More]

Bitcoin Can Be Used for Remittances

Bitcoin has the potential to play a valuable role in the global remittance market, where people send money to family and friends abroad. Traditionally, this process involved significant fees and intermediaries. In 2019, the World Bank estimated that remittances to low- and middle-income countries would reach $550 billion, with $540 billion sent in 2020, despite the challenges posed by the COVID-19 pandemic.

Bitcoin enthusiasts argue that it can streamline remittances by eliminating intermediaries and reducing costs. However, there are hurdles to overcome. Bitcoin network fees can make it impractical for most remittances, particularly small ones. Moreover, there are concerns about the potential misuse of cryptocurrencies for money laundering.

In the conventional remittance process, a customer in the sender’s country pays local currency to a Money Transfer Operator (MTO). The recipient receives the money in the destination country’s currency, minus fees charged by the MTO. Many MTOs rely on larger remittance software providers like Western Union or Moneygram, which take a significant share of the fees. This infrastructure is costly, especially for smaller transactions. Fees can range from 5% to 9.3% for a $200 remittance, depending on factors like the destination and service type. Compliance with regulations like Know Your Customer (KYC) and Anti-Money Laundering (AML), as well as capital controls, adds to these expenses.

Bitcoin’s borderless nature makes it an attractive option for international remittances, bypassing banks and traditional remittance providers. Several blockchain startups offer user-friendly services to facilitate bitcoin remittances. These services replace traditional remittance providers with software that enables bitcoin transactions. Money Transfer Operators can estimate their daily operational needs, purchase the equivalent amount of bitcoins, and promptly convert them into fiat currency in the recipient’s nation, with transactions completing within minutes.

Bitcoin’s role as a treasury reserve

Bitcoin’s role as a treasury asset has gained attention in recent years, with some companies and institutional investors adding it to their balance sheets. As a treasury asset, Bitcoin serves a different purpose than its role as a digital currency or investment. Here’s a brief overview of Bitcoin’s use as a treasury asset:

- Store of Value: Bitcoin is often seen as a digital store of value, similar to gold. Companies holding it in their treasuries view it as a way to preserve and potentially increase the value of their assets over time, especially in an environment of potential currency devaluation.

- Diversification: Adding Bitcoin to a treasury can diversify the company’s holdings. This is particularly appealing when traditional investments like stocks, bonds, or cash may be subject to economic uncertainties or inflation risks.

- Long-Term Investment: Many companies view Bitcoin as a long-term investment rather than a short-term trading asset. They may have a “buy and hold” strategy, expecting the value to appreciate over several years.

- Hedging Against Fiat Currency Depreciation: Holding Bitcoin can act as a hedge against the depreciation of fiat currencies. This is especially relevant for companies concerned about the potential devaluation of their local currency.

- Corporate Strategy: Some companies embrace Bitcoin as part of their corporate strategy, signaling their belief in the future of digital assets and blockchain technology. This can attract investors and customers who share a similar vision.

- Financial Flexibility: Bitcoin provides companies with financial flexibility. They can easily convert it into cash when needed, allowing them to react to market opportunities or cover unexpected expenses.

Bitcoin for Corporations 2022 – Corporate Strategy-Link

Public Companies that Own Bitcoin

| Entity | Symbol:Exchange | BTC |

|---|---|---|

| MicroStrategy | MSTR:NADQ | 152,800 |

| Marathon Digital Holdings Inc | MARA:NADQ | 13,286 |

| Tesla, Inc | TSLA:NADQ | 10,725 |

| Hut 8 Mining Corp | HUT:NASDAQ | 9255 |

| Coinbase Global, Inc. | COIN:NADQ | 9,000 |

| Galaxy Digital Holdings | BRPHF:OTCMKTS | 8,100 |

| Block, Inc. | SQ:NYSE | 8,027 |

| Riot Platforms, Inc. | RIOT:NADQ | 7,309 |

| Bitcoin Group SE | BTGGF:TCMKTS | 3,830 |

| Voyager Digital LTD | VOYG:TSX | 2,287 |

| HIVE Digital Technologies | HIVE:NASDAQ | 2,032 |

| NEXON Co. Ltd | NEXOF:OTCMKTS | 1,717 |

| CleanSpark Inc | CLSK:NASDAQ | 1677 |

| Exodus Movement Inc | EXOD:OTCMKTS | 1,300 |

| Brooker Group’s BROOK (BKK) | BROOK:BKK | 1,150 |

| Meitu | HKD:HKG | 941 |

| Bit Digital, Inc. | BTBT:NASDAQ | 758 |

| Bitfarms Limited | BITF:NASDAQ | 654 |

| Phunware, Inc. | PHUN:NASDAQ | 630 |

| NFT Investments PLC | NFT:AQSE | 626 |

| Cipher Mining | CIFR:NASDAQ | 519 |

| DMG Blockchain Solutions Inc. | DMGGF:OTCMKTS | 477 |

| Neptune Digital Assets | NPPTF:OTCMKTS | 261 |

| Advanced Bitcoin Technologies AG | ABT:DUS | 254 |

| DigitalX | DGGXF:OTCMKTS | 216 |

| LQwD FinTech Corp | LQWDF:OTC | 151 |

| MercadoLibre, Inc. | MELI:NADQ | 150 |

| BIGG Digital Assets Inc. | BBKCF:OTCMKTS | 150 |

| Banxa Holdings Inc | BNXAF:OTCMKTS | 136 |

| BTCS Inc. | BTCS:OTCMKTS | 90 |

| Digihost Technology Inc. | HSSHF:OTCMKTS | 82 |

| Canada Computational Unlimited Corp. | SATO:TSXV | 75 |

| FRMO Corp. | FRMO:OTCMKTS | 63 |

| Argo Blockchain PLC | ARBKF:OTCMKTS | 49 |

| SATO Technologies Corp. | SATO:TSXV | 36 |

| Metromile | MILE:NASDAQ | 25 |

| MOGO Financing | MOGO:Nasdaq | 18 |

| Net Holding Anonim Sirketi | NTHOL TI:IST | 3 |

Private Companies that Own Bitcoin

| Entity | BTC |

|---|---|

| Mt. Gox | 200,000 |

| Block.one | 140,000 |

| Tether Holdings LTD | 55,000 |

| The Tezos Foundation | 17,500 |

| Stone Ridge Holdings Group | 10,000 |

| Massachusetts Mutual | 3,500 |

| Lisk Foundation | 1,898 |

| Seetee AS | 1,170 |

| Luna Foundation Guard | 313 |

Bitcoin As Legal Tender

Bitcoin’s recognition as legal tender is a groundbreaking development in the world of finance. It means that individuals and businesses can now use Bitcoin for everyday transactions, just like traditional currencies. This move towards embracing Bitcoin opens up new avenues for financial freedom and innovation, allowing people to access a decentralized and borderless form of money. However, it also raises questions about regulatory frameworks and the potential impact on traditional financial systems. Regardless, it’s a remarkable step towards a future where digital currencies like Bitcoin play a more prominent role in our daily lives, shaping the way we conduct transactions .

| # | Country | Date |

|---|---|---|

| 1 | Central African Republic | from 4/23/2022 |

| 2 | El Salvador | from 6/9/2021 |

Time-Locked Contracts in Bitcoin

Time-locked contracts in the context of Bitcoin refer to smart contracts that have specific conditions or restrictions based on time. These contracts are programmed to execute or enforce certain actions only after a predetermined period has elapsed. Here’s a brief explanation:

- Delay Mechanism: Time-locked contracts incorporate a delay mechanism, which means that the contract’s rules or conditions are not immediately enforced upon creation. Instead, they become active and executable after a specified time duration.

- Use Cases: Time-locked contracts have various use cases in the Bitcoin ecosystem. For example, they can be employed for escrow arrangements, where funds are locked for a specific time to ensure that both parties fulfill their obligations. They are also used in certain types of savings accounts or investment vehicles that restrict access to funds for a predefined period.

- Security and Trustlessness: These contracts enhance security and trustlessness in Bitcoin transactions. By setting time-based conditions, parties can reduce the risk of fraud or disputes. For instance, in a multi-signature wallet, time-locked contracts can prevent one party from withdrawing funds prematurely.

- Layer 2 Solutions: Time-locked contracts are also utilized in layer 2 solutions like the Lightning Network, which enables faster and cheaper Bitcoin transactions off-chain. Lightning Network channels often incorporate time-locked contracts to ensure that participants follow the established rules when closing a payment channel.

- Programming Flexibility: These contracts offer programming flexibility, allowing developers to create a wide range of applications and financial instruments on the Bitcoin blockchain. This flexibility is crucial for expanding Bitcoin’s utility beyond simple transactions.

In-game currencies

Traditionally, in-game currencies have been confined to virtual realms, limited to specific gaming environments. However, the integration of Bitcoin as the native unit of currency in video games heralds a significant shift. This innovative approach not only incentivizes active participation within the gaming community but also paves the way for the emergence of genuine in-game economies with real-world implications.

Bitcoin’s integration injects a sense of tangible value into the gaming experience. It allows gamers to earn rewards and assets within the virtual world that carry real-world value outside of it. This transformative concept extends beyond entertainment, as it empowers developers to gamify even the most mundane tasks, offering players compensation that holds actual economic significance.

In essence, Bitcoin’s presence within video games transcends the boundaries of virtual reality, bridging the gap between digital and tangible assets. It not only enriches the gaming experience but also introduces exciting possibilities for the future of gaming and virtual economies.

Bitcoin NFTs

In the dynamic world of digital assets, Bitcoin NFTs have emerged as a game-changer. In this article, we explore Bitcoin Non-Fungible Tokens (NFTs), their significance, uses, and how they’re reshaping the crypto landscape.

What Exactly Are Bitcoin NFTs?

Bitcoin NFTs, or Bitcoin Non-Fungible Tokens, are unique digital assets residing on the Bitcoin blockchain. Unlike regular Bitcoin (BTC), which can be exchanged equally, Bitcoin NFTs are one-of-a-kind digital collectibles, securely recorded on the blockchain, ensuring their authenticity.

The Origin Story of Bitcoin NFTs

Bitcoin NFTs were born out of the desire to make Bitcoin more versatile. Beyond its role as a digital currency, NFTs have unlocked a world of possibilities on the Bitcoin blockchain.

Key Features of Bitcoin NFTs

- Uniqueness: Each Bitcoin NFT is rare and exclusive, often representing art, collectibles, or special digital content.

- Immutable Ownership: Thanks to the blockchain’s transparent ledger, Bitcoin NFT ownership is unquestionable.

- Interoperability: Bitcoin NFTs can be effortlessly traded within the Bitcoin network or other compatible blockchains, boosting liquidity.

- Decentralization: Like Bitcoin itself, Bitcoin NFTs operate without intermediaries, enhancing security.

Bitcoin NFT Applications

1. Digital Art and Collectibles

Bitcoin NFTs have revolutionized digital art and collectibles by providing proof of origin and creator royalties.

2. Gaming

Gamers can now own, trade, and use in-game assets across various games, creating vibrant in-game economies.

3. Real Estate and Tokenization

Real estate transactions may become faster and more secure as Bitcoin NFTs represent property ownership.

4. Intellectual Property

Creators can protect their work and earn fair compensation by minting Bitcoin NFTs.

How to Create and Trade Bitcoin NFTs

- Minting: Use a trusted NFT marketplace compatible with Bitcoin to mint your unique NFT.

- Ownership Transfer: Transfer NFTs securely to others, with changes recorded on the blockchain.

- Trading: List NFTs on marketplaces for potential buyers.

- Storage: Store Bitcoin NFTs in a secure digital wallet supporting the Bitcoin network.

Challenges and the Road Ahead

While Bitcoin NFTs hold promise, they face challenges like scalability and environmental concerns due to Bitcoin’s energy-intensive Proof of Work (PoW). Yet, the crypto community is actively seeking solutions.

In conclusion, Bitcoin NFTs represent a new era for digital assets, offering opportunities across industries. Their unique features, versatility, and decentralized nature make them a powerful force in the crypto world. As the crypto community innovates, Bitcoin NFTs are set to play a pivotal role in shaping the future of finance, art, gaming, and more.

Ready to explore the boundless world of Bitcoin NFTs? Dive in today and discover the future of digital uniqueness and decentralization!

sources

BIG IDEAS 2023: BITCOIN

buybitcoinworldwide:link

Naren is a finance graduate who is passionate about cryptocurrency and blockchain technology. He demonstrates his expertise in these subjects by writing for cryptoetf.in. Thanks to his finance background, he is able to write effectively about cryptocurrency.