Learn how cross-chain bridges operate and how they can be used to transfer cryptocurrencies, NFTs, and other digital assets between different blockchain networks. Discover the most popular use of cross-chain bridges for token transfer, and explore how these bridges can be used for other amazing applications like smart contract conversion and data transmission.

How Do Cross-Chain Bridges Operate?

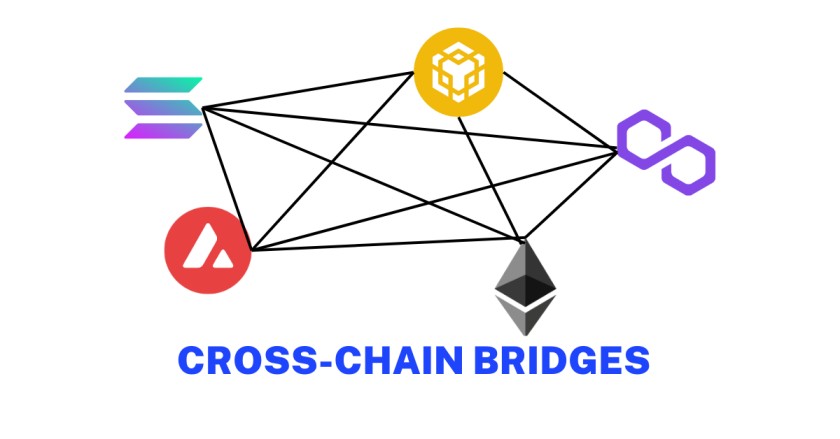

Software applications called cross-chain bridges make it possible for transactions to take place between different blockchains. Cross-chain bridges are a crucial component of the process if someone wants to transfer cryptocurrencies, non-fungible tokens (NFTs), or other digital assets between blockchain networks. Although the majority of digital assets are linked to a single blockchain, cross-chain bridges allow for inter-network transactions that support a much larger digital ecosystem. Owners of cryptocurrencies can access the value locked up in their portfolios for a wider range of practical uses by using cross-chain bridges.

The most popular usage of cross-chain bridges is token transfer, while they can also be used for other amazing things like converting smart contracts and transmitting data.

Before blockchain bridges, if you wanted to use a certain asset on another blockchain, you would have to rely on the services of centralised exchanges (CEXs), such as Binance or Coinbase.

Assume for the moment that you have some BTC on the Bitcoin blockchain and wish to transfer these tokens to the Ethereum blockchain, which has a native ETH token. You must submit your BTC to a cross-chain bridge in order for it to store your coin and generate counterparts in ETH for you to utilise.

The Ethereum network does not get your BTC directly from the Bitcoin network. Instead, it is protected by a smart contract that gives you access to an equivalent amount of wrapped Bitcoin (wBTC), which is a digital currency that can be used on the Ethereum network. If you choose to convert the wBTC back to BTC, any remaining wrapped token will be burned (destroyed), and you will be awarded an equivalent amount of BTC.

What Supports Cross-Chain Bridges Value in the Crypto Ecosystem?

To fully appreciate the relevance of cross-chain bridges in the cryptocurrency industry, it is essential to understand how interoperability promotes efficient transactions in traditional banking. You may not be aware of this, but you can use your Visa card to pay your Mastercard invoices. Almost all of your online purchases may be made with PayPal in a manner similar to this, regardless of the merchant.These are all separate companies using various platforms and protocols. However, transactions go smoothly and quickly. The inability of different blockchains to communicate with one another has been recognised as one of the obstacles preventing the general adoption of cryptocurrencies. Cross-chain bridges, for example, are a crucial step towards widespread usage of blockchain technology.

Cross-chain bridges enable users to benefit from the best characteristics of two blockchains, including better utility in the form of DApps and cheaper gas fees with higher transaction throughput.

What digital assets provide cross-chain bridges?

No specific coin or network is required for cross-chain bridges to function. If software engineers with the necessary training and expertise design cross-chain bridges, any blockchain network might be interoperable with them.

Are different blockchain networks compatible with a cross-chain bridge?

If the software is made to be interoperable with all blockchains, cross-chain bridges can communicate with them. However, security incidents may happen more frequently on increasingly complicated blockchains.

Are chain-crossing bridges secure?

Compared to other blockchain applications, cross-chain bridges have particular hazards. As a software application constructed on top of other blockchains, the cross-chain bridge is susceptible to hacking if there is a flaw in either the blockchain software or the smart contract powering it.

Why Chain Bridges Are Required in Web3

Because they frequently lack the capability to observe or comprehend what is happening on other networks, blockchains are unable to naturally communicate with one another. Communication between chains is challenging due to the fact that each chain has its own set of regulations on protocol design, money, programming language, governance structure, culture, and other factors. The amount of economic activity that may occur in the Web3 ecosystem is constrained by this lack of inter-blockchain communication since, in the absence of it, different networks effectively represent different isolated economies that are not connected to one another.

Imagine blockchains as several continents connected by immense oceans to better comprehend the necessity of cross-chain bridges. The natural resources in Region A are abundant, the agricultural area in Region B is productive, and the manufacturing sector is thriving and there are many talented artisans in Region C. We could create a thriving world if we could unite the resources of these continents. But these locations wouldn’t be able to take advantage of their talents without a mechanism to connect their various economies through ports, bridges, tunnels, or other infrastructure.

The ecosystem may profit from the unique characteristics of each blockchain ecosystem by enabling communication across several blockchains, scaling options, and app-specific chains.

Type of cross chain bridge

There are three primary mechanisms used to power cross-chain bridges:

Lock and mint is the process of minting wrapped tokens as an IOU on the destination chain after a user locks tokens in a smart contract on the source chain. The wrapped tokens on the destination chain are burnt in the opposite manner to reveal the original coins on the source chain.

Burn and mint: A user mints native tokens on the destination chain after burning the identical tokens on the source chain.

Lock and unlock: On the source chain, a user locks tokens; on the destination chain, he or she unlocks the same native tokens from a liquidity pool. Typically, these cross-chain bridges draw liquidity from the economy on both sides of the bridge.

Additionally, cross-chain bridges can be used in conjunction with arbitrary data transmission capabilities, enabling the transfer of any kind of data, not just tokens, between blockchains. These programmable token bridges combine token bridging and arbitrary messaging, and after the tokens are transferred to the destination network, a smart contract call is made on that chain. Upon completion of the bridge function, programmable token bridges allow for more sophisticated cross-chain capabilities. In the same transaction that the bridging function is carried out, these options include loan, staking, trading, or depositing the tokens in a smart contract on the destination chain

The Difficulties of Chain Bridging

It can be difficult to securely communicate between blockchains without a reliable third party. Interactions that take place on different blockchains do not need to make security, trust, or flexibility trade-offs, but cross-chain communication inevitably must. Additionally, this means that composability between smart contracts on separate blockchains can only be attained by sacrificing security, trust, or configuration flexibility, which is not necessary for composability between smart contracts on the same chain. Why not just put all application activity on a single blockchain if there are constraints to cross-chain messaging? This can be done in two ways,

First, if decentralization and genuine neutrality are key principles of the network, there are theoretical limits to how much activity a single blockchain can process due to computer power, bandwidth, and storage capacities. The requirement for numerous chains and solutions arises from the fact that different blockchains and scaling solutions optimize for different attributes, such as speed, security, and decentralization. It is likely that there will always be disagreement as to the ideal combination of these values. The utilization of wrapped assets versus native assets is a crucial consideration when discussing cross-chain bridges. As a representation of another asset on the source blockchain, wrapped or bridged assets bring several types of security and trust assumptions due to the need for one or more.

Rabi is the founder of Cryptoetf.in and a regular contributor. He is passionate about the crypto world and keeps up-to-date with the latest developments, always eager to share his knowledge with readers.