As the name suggests, a bitcoin ATM functions similarly to a standard ATM, but it only accepts bitcoin as payment.

What Is a Crypto ATM?

Users can purchase and sell cryptocurrencies via standalone electronic kiosks known as cryptocurrency automated teller machines (ATMs) in return for cash or a debit card. In addition to selling Bitcoin, all cryptocurrency ATMs also sell other cryptocurrencies. Not all cryptocurrency ATMs permit cryptocurrency sales; others only permit purchases.

As contrast to traditional ATMs, which connect to your bank account, cryptocurrency ATMs conduct transactions and send cryptocurrency to users by establishing a connection with their digital wallets. Tens of thousands of cryptocurrency ATMs are present worldwide, the most of which are found in the US.

Before using a cryptocurrency ATM, you should be familiar with digital wallets and how they function.

What is a Crypto wallet?

Like your physical wallet, a cryptocurrency is a way to store money. You may track, transmit, and receive funds using a bitcoin wallet, which can be either a hardware or software application.

In order to send and receive digital currency, check your balances, and manage your transactions, you need to use a crypto wallet, which is a piece of software that holds your public and private keys and communicates with different blockchains. You can use it to transmit, store, and receive cryptocurrencies like Bitcoin, Ethereum, and others in a safe manner.

There are various kinds of cryptocurrency wallets, such as:

Hot wallets are more user-friendly and connected to the internet; nevertheless, they are also more susceptible to hacking. Mobile, desktop, and web wallets are a few types of popular wallets.

Cold wallets: are more secure than online wallets but less user-friendly because they are not connected to the internet. Hardware wallets and paper wallets are two types of cold wallets.

Why are crypto wallets important?

Crypto wallets technically don’t store your crypto, in contrast to a typical wallet, which can hold real money. Your holdings are stored on the blockchain but require a private key to access. Your keys enable transactions and serve as proof of ownership for your digital currency. You can’t access your money if you misplace your secret keys. Use a reputable wallet service like Electrum or keep your hardware wallet secure for this reason.

Types of Bitcoin Wallets

Crypto wallets come in a variety of designs, just like physical wallets, and each compromises between ease of use and theft protection.

Online wallets

Look for software or an app that stores keys and is protected by two-step encryption. This makes using, sending, and receiving your cryptocurrency as simple as using any online brokerage, payment system, or bank account.

Hardware wallets

Keys are stored in a thumb-drive device that is kept in a safe place and only connected to a computer when you want to use your crypto. The idea is to try to balance security and convenience.

Paper Wallets

The keys are on a thumb drive that is kept in a safe place and is only connected to a computer when you want to use your cryptography. The objective is to balance convenience and security.

What to Consider When Picking a Bitcoin Wallet?

Here are some things to consider as you consider your options in order to select the best cryptocurrency wallet for you.

| Coinbase Wallet | Best for Beginners |

| MetaMask | Best for Ethereum |

| Electrum, Exodus | Best Desktop Bitcoin Wallet |

| www.walletgenerator.net | Best Paper Wallets |

| Ledger, Trezor, Ellipal Titan, SafePal, Blockstream Jade | Best hardware wallets |

| Crypto.com | Best deFi wallet |

You can have many Bitcoin wallets you are not permanently bound to one type. Combining the best aspects of each, you might retain a small amount in a mobile wallet for transactions while keeping the majority of your assets in a hardware wallet for increased security.

let’s begin with crypto for now.

Types of Bitcoin ATMs?

There are two main types of Bitcoin ATMs: one-way and two-way.

One-way Bitcoin ATMs: These ATMs allow you to buy Bitcoin with cash or a debit card. You insert your cash or swipe your debit card, and the ATM dispenses Bitcoin in the form of a paper receipt or by transferring the Bitcoin to your Bitcoin wallet.

Two-way Bitcoin ATMs: These ATMs not only allow you to buy Bitcoin, but also allow you to sell Bitcoin. You can sell your Bitcoin by transferring it to the ATM and receiving cash in return.

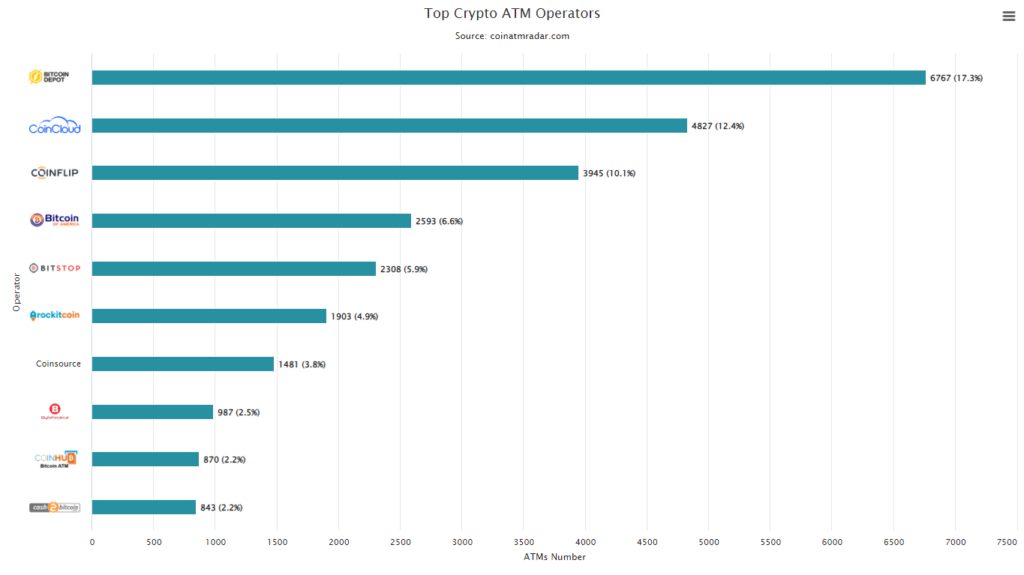

Top Crypto ATM Operators

Bitcoin ATM Map

Approximately 35,000 BTMs exist worldwide.You can use Coin ATM Radar to do a local search to identify the precise location of a Bitcoin Teller Machine nearby. To locate the closest BTM, simply enter your address or city.

How to use a Bitcoin ATM?

The procedure for using a Bitcoin ATM can vary based on the particular ATM and the area, but it is generally straightforward. The general procedures for utilising a Bitcoin ATM are as follows:

- Locate a Bitcoin ATM: To find a Bitcoin ATM close to you, utilise a map or list of Bitcoin ATMs.

- Prepare your wallet: Make sure your phone or computer has a Bitcoin wallet loaded, and that you are prepared with your wallet address.

- Start the transaction:To begin the transaction, approach the ATM and adhere to the instructions displayed on the screen. You might need to manually enter your wallet’s address or scan its QR code.

- Select your transaction type: Enter the quantity of Bitcoin you wish to purchase, sell, or convert to cash in exchange for. The corresponding quantity in Bitcoin or cash will be determined by the ATM.

- Enter the amount: Enter the amount of Bitcoin you want to buy or sell, or the amount of cash you want to exchange for Bitcoin. The ATM will calculate the corresponding amount in Bitcoin or cash.

- Insert cash or scan your debit card: If you are buying Bitcoin, insert cash into the ATM or scan your debit card. If you are selling Bitcoin, the ATM will typically ask you to transfer the Bitcoin to a specific address.

- . Confirm the transaction: Review the details of the transaction and confirm that everything is correct.

- Collect your receipt or Bitcoin: If you are buying Bitcoin, the ATM will typically dispense a paper receipt with a code that you can use to redeem your Bitcoin. If you are selling Bitcoin, the ATM will typically transfer the cash to your account or dispense it in the form of physical bills.

It’s crucial to carefully read the instructions on the screen, abide by them, and double-check the information before finalising the transaction. When using Bitcoin ATMs, it’s crucial to exercise caution because they can be targets for scammers.

Be aware that processing time for transactions made at a Bitcoin ATM might range from ten minutes to an hour. Don’t be concerned if you don’t see the money reflected in your digital wallet right now because it often takes six network confirmations to do this.

There are several advantages to using Bitcoin ATMs:

- Convenience: Bitcoin ATMs are generally available 24/7 and are easy to use, making them a convenient way to buy or sell Bitcoin.

- Fast transactions: Bitcoin ATMs allow you to buy or sell Bitcoin quickly and easily, without the need to wait for bank transfers or go through a lengthy registration process.

- Privacy: Bitcoin ATMs offer a high level of privacy, as you can buy or sell Bitcoin without providing any personal information or linking your bank account.

- Accessibility: Bitcoin ATMs can be found in many locations around the world, making it easier for people in underbanked or unbanked areas to access Bitcoin.

- Diversification: Bitcoin ATMs allow you to diversify your investment portfolio by buying or selling Bitcoin as a financial asset.

Yes, there are several disadvantages to using Bitcoin ATMs:

- High fees: Bitcoin ATMs generally charge higher fees than traditional exchanges, so it’s generally more cost-effective to buy and sell Bitcoin online.

- Limited transaction amounts: Bitcoin ATMs often have limits on the amount of Bitcoin you can buy or sell in a single transaction.

- Limited accessibility: While Bitcoin ATMs can be found in many locations around the world, they are not as widely available as traditional exchanges or online platforms.

- Limited coin selection: Many Bitcoin ATMs only support Bitcoin, so you may not be able to buy or sell other cryptocurrencies.

- The majority of places require identity verification, so your transaction won’t be entirely anonymous.

Bitcoin ATM Fees

For their services, bitcoin ATMs often charge a fee. Depending on the particular ATM, the location, the kind of transaction you are conducting, and other factors, these costs can differ dramatically.

The following are some examples of the different kinds of fees you might pay when using a Bitcoin ATM:

Fees for purchases: A lot of Bitcoin ATMs impose a cost for purchasing Bitcoin. This fee normally represents a percentage of the overall transaction amount and may be as high as 15%.

Some Bitcoin ATMs have a fee associated with selling bitcoin.

This fee normally represents a percentage of the overall transaction amount and may be as high as 15%.

Convert fees: You can exchange Bitcoin for other cryptocurrencies at some Bitcoin ATMs, but they might charge you a fee for the privilege.

This fee normally represents a percentage of the overall transaction amount and may be as high as 15%.

Network fees: In addition to transaction fees, certain Bitcoin ATMs may also charge network fees, which are charges made to the Bitcoin network for handling transactions.

These fees, which are often a small portion of the entire transaction value, are used to defray the network’s operating expenses.

Before making a choice, it’s crucial to carefully analyse the costs levied by various Bitcoin ATMs. It is normally more cost-effective to purchase and sell Bitcoin online because Bitcoin ATMs typically charge greater costs than conventional exchanges. However, if you prefer to use cash or don’t have a bank account, Bitcoin ATMs can be a convenient choice for quickly and conveniently purchasing small amounts of Bitcoin.

Naren is a finance graduate who is passionate about cryptocurrency and blockchain technology. He demonstrates his expertise in these subjects by writing for cryptoetf.in. Thanks to his finance background, he is able to write effectively about cryptocurrency.