The cryptocurrency market attracts not only experienced investors but also regular folks who have never purchased bitcoin before. Although bitcoin (BTC) was the first cryptocurrency and is now the most valuable by market capitalization, other coins (altcoins), such as Ethereum (ETH), dogecoin (DOGE), and many more, quickly gained popularity.

There are currently 20000 cryptocurrencies, many of which, to be honest, don’t look that promising. Therefore, it’s crucial to learn how to identify coins that are worth your time and money. This tutorial will teach you seven efficient ways to assess a cryptocurrency, giving you more confidence when you invest.

Why Purchase Cryptocurrency?

Since money has been changing its forms for many years, cryptocurrencies represent a unique approach to digital money. With cryptocurrencies, you benefit from the decentralisation, encryption, immutability, and transparency of blockchain technology.

Naturally, a first-time bitcoin buyer would search for estimates of value they can obtain from their cryptocurrency assets. You already have the advantage of being the owner of a brand-new, special digital asset that might increase in value significantly in the future. Additionally, a lot of bitcoin currencies and tokens are made with certain utility in mind.

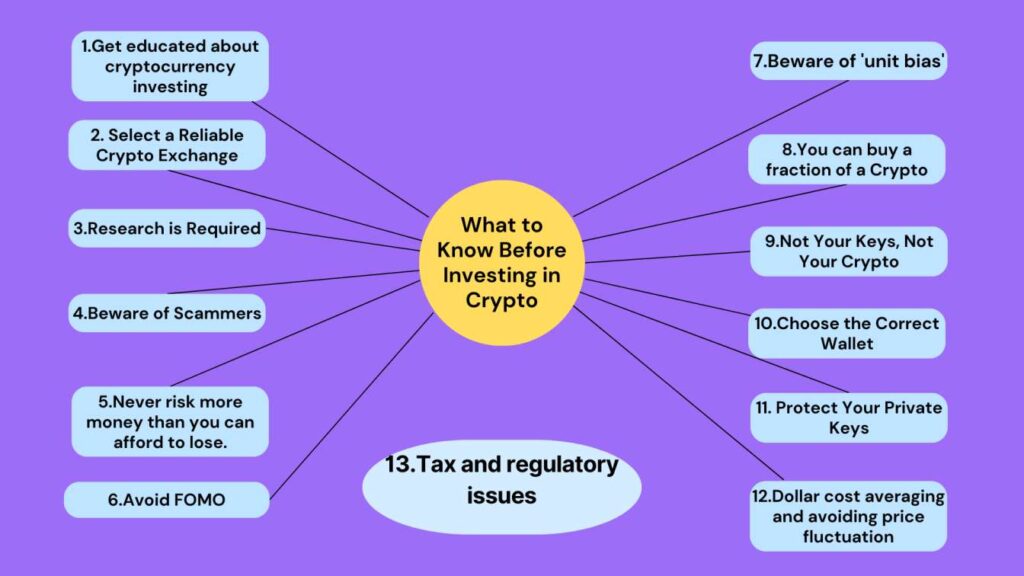

What to Know Before Investing in Crypto

1.Get educated about cryptocurrency investing

The review of methods for buying, trading, and exchanging cryptocurrencies is the first thing you need to know about buying cryptocurrencies. You cannot invest your money in cryptocurrencies blindly if you have no clue how to approach them.

Find the systems that enable you to add and remove fiat money from a crypto ecosystem. The crypto platform allows you to examine all the fundamental stages, including the straightforward purchase and sale possibilities. You are more likely to make wise decisions when you have confidence in the procedures for purchasing, selling, and exchanging cryptocurrency.

Want to learn more about blockchain and cryptocurrency technology? visit this page for free resources

2. Select a Reliable Crypto Exchange

Look for a crypto exchange with high liquidity levels, a wide selection of crypto assets, dependable security protocols, and these qualities. few Important Considerations to Help You Pick a Crypto Exchange.

- Verify the maximum number of coins you can trade.

- Make sure there is enough liquidity.

- Examine the costs.

- Make sure there is adequate security.

- Think about the controls.

- Examine the insurance policy.

- Take control of the tax reporting.

3.Research is Required

The emphasis on research is undoubtedly the most important component to any tutorial on bitcoin investing. Before making an investment of any kind, you should do some thorough study. You can learn about the value you can acquire from cryptocurrencies by spending hours researching its history and uses.

Research also enables you to become aware of the dangers connected to the particular cryptocurrency of your choice. If you’re thinking about making investments in a cryptocurrency, be careful not to buy into the fallacy that “someone will buy it at a better price in the future.”

Research is a crucial component of buying cryptocurrency advice, and the abundance of information available regarding cryptocurrencies makes it clear how important it is. Look for community forums, online groups, mailing lists for cryptocurrency developers, Visit the project webpage, Read the white pape. Examine social media platforms, Analyze the collaborations and project team, Examine the market metrics for cryptocurrencies, Identify the utility of the cryptocurrency.

Develop your knowledge of cryptocurrencies, as well as related topics like economics and cryptography. To make a more informed decision regarding cryptocurrencies when it comes to investing, eliminate all of your doubts about them and study everything there is to know about them.

4.Beware of Scammers

You might notice a lot of talk on social media for an investment technique that claims to provide enormous returns from mysterious crypto assets. Others overstate predictions about how Bitcoin’s price will increase. Sadly, there are some dishonest players in the cryptosphere, and exit scams and Ponzi schemes have cost billions of dollars. A quick primer on avoiding cryptocurrency scams may be found on the CoinMarketCap blog, as can one here on keeping your cryptocurrency secure.

Fear of missing out, or FOMO, is a psychological state that scammers frequently depend on. Before investing in cryptocurrencies, exercise caution and keep in mind the adage that, in most cases, if something sounds too good to be true, it probably is. You can make an informed choice thanks to the abundance of unbiased evaluations and fiercely independent news sources in the bitcoin business.

5.Never risk more money than you can afford to lose.

More risky than many other investments is cryptocurrency. The only thing that is certain is volatility. Cryptocurrency prices fluctuate significantly from minute to minute. The market has had painful, protracted corrections, and it almost surely will again even though it is currently enjoying in the heat of a bull run.

The first cryptocurrency, Bitcoin, has been existing for more than ten years and is much less likely to vanish than most other coins. But there are other risks involved.

So, don’t stake everything, including your life savings, on any crypto.

6.Avoid FOMO

Popular cryptocurrencies might experience a swift and steep price increase during a bull market. Exercise cautious because investing in Crypto at high prices could result in severe losses if it corrects.

7.Beware of ‘unit bias’

The fundamental premise of unit bias is that a cryptocurrency trading at $50,000 per unit is preferable to a coin trading at $1. However, if you’re considering purchasing cryptocurrencies, you must abandon such presumptions. You are likely to discover a wide selection of functionalities given that there are hundreds of cryptocurrencies in existence worldwide.

As different cryptocurrencies have distinct functionality, the buying advice for cryptocurrencies would definitely call attention to reducing “Unit Bias.” For instance, some might offer better development assistance while others might have better decentralisation. Therefore, learning more about the technological foundations of a particular cryptocurrency might reveal a lot about its potential.

8.You can buy a fraction of a Crypto

The potential for fractional ownership of cryptocurrencies is yet another strong indicator for any first-time cryptocurrency investor. For instance, you don’t need to worry about buying one entire Bitcoin to prove your possession of a cryptocurrency. You can now buy cryptocurrency thanks to fractional ownership. Dogecoin in little quantities is among the best examples. You don’t have to invest your entire portfolio in a certain cryptocurrency as a result.

9.Not Your Keys, Not Your Crypto

“Not your keys, not your Crypto” is a popular expression in the world of cryptocurrencies – and a very important one at that. Without owning your keys, you wouldn’t really be in control of your coins.

There are several reasons why you should keep control of your keys rather than giving them to a third party and giving them access to your money. The most obvious one is unintentionally handing it over to bad guys. You probably won’t get your money back if you gave it to a dishonest third party. Thankfully, with well-established businesses, this is highly unusual.Even then, you’ll never have complete control over your own finances when dealing with them. As previously noted, they have the authority to impose limitations like a maximum withdrawal cap or usage fees. What you can do with your own hard-earned money is up to them to decide. You are essentially locked out of your cryptocurrency holdings if their platform encounters any technical difficulties. In other words, until you have financial independence and control over your money, you won’t have ownership of your keys.

10.Choose the Correct Wallet

The selection of an appropriate crypto wallet for your cryptocurrencies is another important consideration. In essence, cryptocurrencies are assets that the person holding them is deemed to be the legal owner of. So selecting a wallet that can securely store the bitcoins must also be a concern while thinking about how to acquire cryptocurrency. On a blockchain, however, crypto wallets function by storing the private keys for the cryptocurrency.

Which kind of wallet should a newbie choose? The typical response would be to point to the bitcoin exchange, which acts as a wallet for cryptocurrencies. DeFi solutions, on the other hand, have experienced some of the worst hacks over the past year. Due consideration should be given when selecting a cryptocurrency wallet to protect your investments.

11. Protect Your Private Keys

You must safeguard your cryptocurrency. A hardware wallet is one of the best methods to do this since it ensures that your crypto assets are kept securely and remote from an internet connection.

12.Dollar cost averaging and avoiding price fluctuation

The goal of the investment approach known as dollar-cost averaging (DCA) is to lessen the effects of volatility. A DCA approach divides the investment into smaller quantities that are invested individually at regular, predetermined periods until the entire amount of capital is used up, as opposed to purchasing a financial instrument in one big payment.

A financial instrument’s volatility is the danger of an upward or downward movement, which is always present in the financial markets. By seeking to reduce the overall average cost of investing, DCA seeks to reduce volatility risk.

Benefits of Dollar-Cost Averaging: 1. A decrease in risk 2. Reduce costs 3. Survive market downturns 4.Disciplined saving 5. Avoids market timing 6. Manage emotional investing

Dollar-Cost Averaging disadvantage:1. Increased transaction fees 2. Priority of asset allocation 3.Low anticipated returns

13.Tax and regulatory issues

The final point of emphasis in this list of bitcoin buying advice would centre on worries about taxes and regulations. For particular reasons, tax and regulatory considerations are significant, particularly in the US. In a similar vein, how cryptocurrencies are viewed legally in various jurisdictions can have a significant impact on the projected returns from investing in cryptocurrencies.

Therefore, before making an investment, you need to have a comprehensive understanding of the tax laws and the crypto rules in your nation or state. While ensuring correct optimization of your returns on the cryptocurrency investment, be sure you don’t break any laws.

Bottom line

One of the biggest obstacles for investors when it comes to cryptocurrencies is not falling victim to the hype. Investors are still being advised by analysts to beware of cryptocurrencies’ high volatility and unpredictable nature. Doing your own research is crucial if you’ve decided to invest in the cryptocurrency market, just like you would with any other investment.

The greatest recommendation is to start small and only use money that you can afford to lose for newcomers who wish to begin trading cryptocurrency.

Naren is a finance graduate who is passionate about cryptocurrency and blockchain technology. He demonstrates his expertise in these subjects by writing for cryptoetf.in. Thanks to his finance background, he is able to write effectively about cryptocurrency.