Introduction

The journey from the inception of the Internet to the creation of Bitcoin stands as a testament to humanity’s unyielding commitment to innovation and progress. This narrative commences with the realm of binary digits and evolves into a digitalized version of one of our society’s most fundamental constructs: money.

The underestimated potential of the Internet gradually unfurled before us. We transitioned from an era where we relied on tangible, physical mediums, such as paper maps, handwritten letters, and landline phones, to an era dominated by digital alternatives. Tools and platforms like Wikipedia, Skype, and Google Drive did more than just replace their predecessors; they reshaped the way we think, communicate, and store information. This transformation was so seamless that pinpointing the exact moment of change became challenging. But at some point, we awakened to a world where “digital” was the new default.

It’s intriguing to draw parallels between this evolution and the transformation of money. For the longest time, money existed in tangible forms – coins, paper notes, gold. Yet, in the latter half of the 20th century, the era of digital transactions emerged, where money transformed into mere numbers on a screen, transferred with a simple click. However, even in this digital realm, these representations were still tied to their physical counterparts. Every digital dollar had a real-world equivalent.

Cryptocurrency, especially Bitcoin, marks a paradigm shift. It introduced the concept of money that is entirely digital, devoid of any tangible form, yet endowed with value. It operates in a decentralized manner, independent of traditional banking systems, and is fortified by the principles of cryptography, offering a layer of security and anonymity.

The journey from conventional payment methods like Visa and PayPal to cryptocurrencies has not been without its challenges. The intricacies of blockchain technology and decentralized finance (DeFi) can be daunting for many. A steep learning curve is involved, and this has posed a roadblock on the path to mainstream adoption of cryptocurrencies.

Nonetheless, much like the early days of the Internet, as infrastructure continues to improve and education spreads, these barriers are slowly receding. Today, the existence of crypto ATMs, the acceptance of Bitcoin by major retailers, and the growing institutional interest in cryptocurrency all signify a future where digital currencies may become as ubiquitous as the Internet services we currently take for granted.

Before the enigmatic figure of Satoshi Nakamoto unveiled Bitcoin to the world in 2008, the groundwork had already been laid by visionaries, cryptographers, and early digital pioneers. This background, vital for understanding the emergence of Bitcoin, is rooted in the convergence of political philosophy, technology, and cryptographic development.

TCP/IP

Back in 1973, two exceptional minds, Vinton Cerf and Robert Kahn, penned a groundbreaking paper that essentially laid the cornerstone for today’s internet. To put it in simple terms, this paper was the starting point, the seed that eventually grew into the enormous tree we now call the internet.

What Cerf and Kahn did was to create a smart way for computers to communicate with each other, and they called it TCP/IP. This wasn’t just any ordinary communication; it was a revolutionary method. Before TCP/IP, computers needed a big, central computer to manage their conversations, like a referee in a game. But TCP/IP changed the game entirely. It allowed computers from all around the world to talk to each other directly, like friends chatting on the phone without a middleman.

Imagine this like the first time someone came up with the idea of a worldwide phone network, where you could call anyone, anywhere, without needing a switchboard operator. TCP/IP made the internet a vast, interconnected web where computers could reach out to each other without waiting for permission or a central boss.

Now, this concept of direct communication between computers, without any central control, was groundbreaking. It became the heart of how the modern internet operates. Think of it as the first puzzle piece that set the stage for building an enormous online city where people could connect, share, and learn.

But TCP/IP didn’t just change the internet; it had a profound impact on the world of cryptocurrencies too. Cryptocurrencies, like Bitcoin, rely on a similar decentralized concept. They use a technology called blockchain to allow people to send and receive money without needing banks or other middlemen. It’s like having a digital wallet that you control, without anyone telling you how to use your money.

In essence, Cerf and Kahn’s paper wasn’t just a beginning; it was a spark that ignited a global conversation, forever changing the way we communicate, do business, and even think about the world. It’s like the first chapter in a book that’s still being written today, a book that’s full of exciting possibilities and innovations, all thanks to their pioneering work.

Public Key Cryptography

In 1976, Whitfield Diffie and Martin E. Hellman made a groundbreaking contribution to the world of computer science by publishing their paper titled “New Directions in Cryptography.” Before their work, the world of secure communication was based on a simple assumption: if two people, say Alice and Bob, wanted to communicate securely, they needed a secure channel to exchange secret keys. This assumption, however, was not practical in the real world. Diffie and Hellman challenged this notion.

Their paper introduced the concept of public-key cryptography and digital signatures. To grasp the significance of their work, it’s essential to understand what cryptography means. Cryptography is all about ensuring secure communication between two parties, say Alice and Bob, even when there’s a sneaky eavesdropper, often referred to as Eve, trying to listen in on their conversation.

Traditionally, cryptography assumed that Alice and Bob could always find a secure way to exchange keys. But Diffie and Hellman questioned this assumption. They proposed a revolutionary idea: what if it was possible for anyone to communicate securely with anyone else over a public channel, without the need for a pre-existing secure connection?

They introduced two innovative approaches: public key cryptosystems and public key challenges. These techniques enabled secure communication over public channels, fundamentally changing how we think about encryption and online security.

For their groundbreaking invention, Diffie and Hellman were honored with the ACM Turing Award, a prestigious recognition often dubbed the “Nobel Prize of Computing.” Their work not only revolutionized the field of cryptography but also laid the foundation for the secure internet protocols we use today. Thanks to their ideas, online communication became safer, paving the way for secure transactions, private messages, and much more in the digital age.

RSA algorithm

The RSA algorithm doesn’t directly help the Bitcoin Foundation or the Bitcoin network, but it does play a role in the broader world of online security, which indirectly impacts Bitcoin and other cryptocurrencies.

Here’s how it works:

Secure Transactions: When you use Bitcoin to make a transaction, your wallet generates a pair of keys: a public key and a private key. These keys are similar in concept to what RSA uses, though Bitcoin uses a different cryptographic system. Your public key is like your public address where people can send you Bitcoin, and your private key is your secret key to access and control your Bitcoin.

Protecting Your Wallet: The security of your private key is crucial. If someone gets hold of it, they can access your Bitcoins. RSA, along with other cryptographic methods, helps in securing the storage and transmission of these keys.

Secure Internet: RSA and other encryption methods also play a crucial role in securing the internet in general. When you connect to a website or a service to manage your Bitcoins, your data is usually encrypted to ensure it can’t be intercepted and understood by hackers. This encryption helps protect your login credentials, personal information, and transactions.

Secure Wallets and Exchanges: Bitcoin wallet services and exchanges employ strong security measures, including encryption techniques, to protect your assets. RSA and other encryption methods contribute to making these services more secure.

While the RSA algorithm isn’t directly related to Bitcoin, it is part of the broader ecosystem of online security. Bitcoin and its infrastructure rely on strong security practices and encryption to keep your digital assets safe. So, the RSA algorithm, along with other encryption methods, indirectly contributes to the security and reliability of the Bitcoin network and the services built around it.

Merkle Trees

In the world of computers and the internet, keeping data safe and secure is a big challenge. Imagine you want to send a big file to someone, and you want to make sure nobody tampered with it during the transfer. Here’s where the concept of Merkle Trees, pioneered by Ralph Merkle, becomes really important.

First, let’s talk about hash functions. A hash function is like a magic tool that turns any piece of data into a unique code, known as a hash. Even if you change a tiny bit of the data, the hash changes completely. This property is crucial for verifying data integrity.

Now, let’s consider sending a large file. If you send the file’s hash along with the data, the recipient can use it to check if the data is intact. But there’s a problem: if someone tampers with the data, they can change the hash too. Also, if even a small part of the data gets corrupted, you have to download the entire file again.

This is where Merkle Trees come in. Instead of sending one hash for the whole file, you break the data into smaller parts and create hashes for each chunk. These smaller hashes are arranged like the branches of a tree, with a final hash at the top called the Merkle Root.

Now, why is this smart? Imagine these smaller data chunks scattered across the internet. For anyone to tamper successfully, they would have to attack every tiny piece and change its hash. That’s nearly impossible in a distributed system like the internet. Plus, if only a small part of the data gets corrupted, you only need to download that specific chunk again, not the entire file.

Now, how does this relate to Bitcoin? Bitcoin transactions are stored in blocks, forming a chain. Each block contains a hash of all the blocks before it. Merkle Trees are used to compute this hash in each block. If someone tries to mess with a transaction in a block, it changes that transaction’s hash, affecting the Merkle Root and invalidating the entire block. This ensures the integrity and security of transactions in the Bitcoin network. In simpler terms, Merkle Trees act like a digital seal, making sure nobody messes with the data, which is essential for the trust and security of systems like Bitcoin.

Blind Signatures

With the rapid advancement of cryptography, researchers delved into the challenge of establishing and verifying identities in distributed systems. In a groundbreaking paper titled “Blind Signatures for Untraceable Payments,” David Chaum tackled a significant problem: the compromise of privacy in financial transactions. In traditional monetary systems, every transaction reveals private information, like where and how money is spent, compromising individual privacy. In today’s world, even credit card histories can construct detailed models of a person’s behavior and preferences.

Chaum proposed a revolutionary solution: a cryptocurrency with unique properties. The system he envisioned had three critical features:

Invisibility to Third Parties: Transactions should be indecipherable to outsiders, safeguarding the identities of the sender, receiver, timing, and amount involved.

Proof of Payment: Individuals must have the ability to prove payment under exceptional circumstances, ensuring accountability without compromising routine transactions.

Stolen Media Prevention: It should be possible to halt the use of payment methods reported as stolen, adding a layer of security.

To achieve these goals, Chaum introduced the concept of blind signatures. A blind signature is a type of digital signature where the content of a message is concealed before signing. This innovation ensures that the party verifying the signature does not gain insight into the entire transaction.

A practical analogy can be drawn from voting. In a non-digital context, when you vote, a verifier ensures your eligibility, stamps your ballot, and registers your name to prevent multiple votes. The actual vote is anonymous, maintaining your privacy. Similarly, in the blockchain realm, two transacting parties, Wallet A and Wallet B, can exchange information without revealing unnecessary details. For instance, Wallet A might require verification that Wallet B is over 21 years old for an alcohol purchase. Instead of sharing personal information directly, Wallet B proves their age to a verifier, who then conveys a digital credential confirming their eligibility to Wallet A, ensuring privacy while achieving the transaction goal.

This concept of blind signatures fundamentally reshaped digital transactions. By de-linking personal information and transaction details, blind signatures uphold privacy, forming the cornerstone of cryptocurrencies and paving the way for secure, private, and accountable digital financial interactions.

FLP Impossibility Theorem

The FLP Impossibility Theorem is a concept in computer science that, in simple terms, highlights a fundamental challenge in designing highly reliable and fault-tolerant computer systems, which are crucial for something like the Bitcoin network.

Here’s a way to understand it:

Imagine you have a group of people (let’s call them computer nodes) who need to agree on something. It could be a decision or a piece of data, like confirming a Bitcoin transaction. Now, let’s say some of these people can be a bit slow or unreliable, maybe due to technical glitches or network issues. The FLP Impossibility Theorem basically says that, in such a situation, you can never guarantee that all the people (nodes) will agree on the same thing in a finite amount of time.

In the context of the Bitcoin Foundation, this concept is important because the Bitcoin network relies on many computers (nodes) reaching a consensus about transactions. The network needs to be extremely reliable and secure to ensure that transactions are processed correctly and that no one can cheat the system.

The FLP Impossibility Theorem reminds us that, in the real world of computer systems, we can’t have both perfect reliability and fast decision-making when some parts of the system are unreliable or slow. So, the Bitcoin Foundation and developers of similar systems have to find creative solutions and use various techniques to make the network as secure and reliable as possible, even when faced with the inherent challenges highlighted by the FLP Impossibility Theorem.

Digicash founded

In 1989, a significant milestone was achieved in the world of digital finance with the creation of DigiCash, a true electronic currency. This innovative currency was the brainchild of David Chaum, a renowned crypto-scientist, and stood as one of the earliest electronic money initiatives.

Chaum’s brilliance in cryptography led to the development of various cryptographic protocols that powered DigiCash. His mathematical expertise gave DigiCash a technological edge, making it more advanced than other electronic currencies available at the time.

Despite its technological prowess, DigiCash faced challenges that resonate with issues encountered by cryptocurrencies today, particularly Bitcoin. Convincing traditional banks to adopt this revolutionary digital currency proved to be an insurmountable hurdle. Additionally, mismanagement and the pioneering nature of the technology rendered the company financially unsustainable. Consequently, DigiCash filed for bankruptcy in 1998.

However, DigiCash’s existence, albeit short-lived, played a vital role in the evolution of cryptocurrencies. It served as a catalyst, generating momentum and interest in the concept of digital currencies. The challenges faced by DigiCash contributed to the lessons learned in the subsequent development of cryptocurrencies, paving the way for the decentralized digital currency revolution that we witness today.

First website

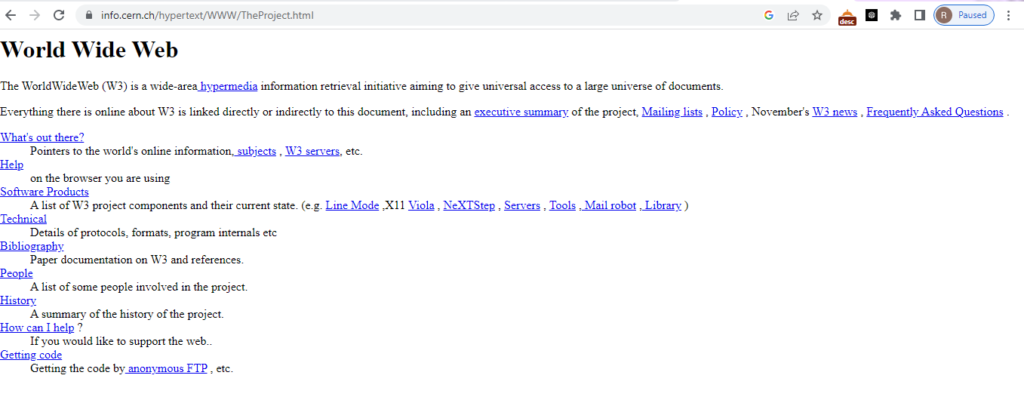

In a pivotal moment in 1990, Tim Berners-Lee, a computer scientist, changed the course of human history by creating the very first website, marking the birth of the internet as we know it today. This groundbreaking development opened the doors to a new era of communication, information sharing, and global connectivity.

The first webpage, a simple yet revolutionary creation, laid the foundation for the vast digital landscape we navigate today. Although the original page no longer exists, its legacy endures through the exact hyperlink where the website once existed. This link serves as a portal to the beginnings of the internet, a virtual time capsule preserving the origins of our online world.

Tim Berners-Lee’s invention was more than just a webpage; it was the inception of the World Wide Web, a revolutionary concept that interconnected people, ideas, and information across geographical and cultural boundaries. The internet became a platform where knowledge could be shared instantaneously, fostering global collaboration and transforming how we communicate, learn, work, and interact with one another.

The creation of the first website was a beacon of innovation, setting in motion a digital revolution that continues to shape every aspect of our lives. From online education and e-commerce to social networking and scientific research, the internet has become an indispensable tool, empowering individuals and communities worldwide.

As we reflect on the humble beginnings encapsulated in the first webpage’s hyperlink, we acknowledge the profound impact of Tim Berners-Lee’s vision. His pioneering work not only created a webpage but also ignited a technological evolution that has reshaped the world, making information accessible to billions and fostering a global community connected by the click of a mouse.

Time-stamping

The concept of time-stamping digital documents in a simple way. It’s like putting a time stamp on a document to prove when it was created or modified. This is incredibly useful in various applications, including cryptocurrencies like Bitcoin.

Here’s how it works:

Users and Time-Stamp Service (TSS): You have users who want to time-stamp their digital documents, like transactions in the case of Bitcoin. They send their requests to a special service called a Time-Stamp Service (TSS).

Creating a Chain: The TSS collects all these requests and creates something like a chain, just like linking dates in a calendar. Each link in this chain contains a piece of information about the documents.

Adding Time Stamps: The key part is that the TSS adds a time stamp to this chain periodically. It’s like marking dates in a diary as time goes by. This time stamp ensures that everyone can see when the chain was last updated.

Proving Authenticity: When users want to prove the authenticity and time of their document, they can check this chain. It’s similar to showing someone the diary with dates to prove when something was written.

In simple terms, this system helps in showing when something happened and that it’s not being altered afterward. It’s like a digital time-travel diary. The chain of time stamps provides a clear history of when documents were created or changed, adding trust and reliability to various applications.

Now, the fascinating thing is that Bitcoin uses a similar idea but with a twist. Instead of relying on a single trusted Time-Stamp Service, Bitcoin decentralizes it. Miners in the Bitcoin network compete to add time stamps to the chain. This competition makes it very secure and resistant to cheating. It’s like a global game where everyone competes to keep the diary accurate, ensuring that all Bitcoin transactions are trustworthy.

This concept isn’t limited to cryptocurrencies; it can be applied in various fields. For example, it can help verify when code was written (like in GitHub), maintain logs of certificates and revocations, create secure file systems (like IPFS), or prove the timing of news articles, educational certificates, and much more. It’s a powerful tool to ensure the trustworthiness and reliability of digital documents in our increasingly digital world.

PGP, or Pretty Good Privacy

PGP, or Pretty Good Privacy, is like a highly secure vault for your digital messages, and it played a vital role in shaping secure communication on the internet. Imagine you’re sending a letter, but instead of a regular lock, you’re using an advanced, unbreakable lock that only the intended recipient can open.

Here’s how it helps the Bitcoin Foundation and other digital networks:

Message Encryption: When you want to send a private message, PGP encrypts it. Encryption transforms your message into a complex secret code. Only the person you’re sending it to, the one with the right key, can decode and read it. For anyone else, it’s like trying to read gibberish, ensuring your private discussions stay confidential.

Sender Verification: PGP also verifies the sender’s identity, ensuring the message hasn’t been altered. It’s akin to a digital seal on an envelope, guaranteeing that the message you receive is genuine and unchanged. This is crucial for secure transactions in the world of cryptocurrencies, where trust is paramount.

PGP acts as a robust guardian for your digital conversations. It shields your messages from unwanted eyes and assures you that the information you receive is authentic and unaltered. This high level of security is vital for the Bitcoin Foundation, ensuring that their communications remain private and trustworthy, laying the foundation for secure transactions in the digital realm. PGP’s role as a defender of digital communication has made it an essential tool in the realm of online privacy and security.

Cypherpunks

The Cypherpunks were a group of computer scientists, cryptography enthusiasts, and activists who emerged in the early 1990s with a shared belief in the need for safeguarding online privacy and liberty. Fearing government and corporate surveillance and control on the internet, they advocated for the use of cryptography to protect individual freedoms. Central to their philosophy was the idea that the internet should remain open and free, devoid of government and corporate intervention, and accessible to all.

The Cypherpunks’ influence on privacy-focused technologies was profound. They championed the development of public key encryption, leading to tools like PGP (Pretty Good Privacy) that enabled secure and private communication. They also pioneered mix networks and anonymous remailers, technologies vital for anonymous online communication. These innovations later formed the basis for projects like Tor, ensuring anonymous internet browsing.

In the realm of cryptocurrencies, the Cypherpunks’ ideals found fruition in Bitcoin. Satoshi Nakamoto, often credited as a Cypherpunk member, introduced Bitcoin in 2008, aligning with the Cypherpunks’ vision of a decentralized, censorship-resistant, and pseudonymous currency. Notable figures like David Chaum, Adam Back, Hal Finney, Craig Wright, Nick Szabo, and Wei Dai, all associated with the Cypherpunks, made significant contributions to the development of cryptographic techniques that influenced the creation of Bitcoin and other cryptocurrencies.

The Cypherpunks’ movement, rooted in the principles of online privacy and liberty, not only drove the development of crucial privacy-focused technologies but also laid the groundwork for cryptocurrencies like Bitcoin. Their legacy continues to shape the landscape of online privacy and digital currencies, emphasizing the importance of individual freedom in the digital age.

eCash

David Chaum is a really important person in the world of digital money. He started working on this stuff way back in the 1980s, a time when the internet was just getting started, long before we had things like websites.

In 1981, Chaum wrote a very important paper about keeping online activities private. This paper helped create tools like Tor, which protect your online privacy. The next year, he wrote about a way to make online payments without anyone being able to see who’s paying or getting paid, which was a new and exciting idea back then.

In 1989, Chaum started a company called DigiCash in Amsterdam. He and his team developed something called eCash. It was like using real money, but for the internet. However, they had a tough time convincing stores and banks to use eCash, and in 1998, they had to close down the company.

Even though eCash didn’t last long, it showed us what the future of online money could look like. It wasn’t exactly like Bitcoin, which came later, but it gave us a hint of digital money backed by banks or big companies, like what we now call central bank digital currencies (CBDCs) and stablecoins.

E-gold

E-gold, founded by Douglas Jackson and Barry Downey in 1996, was a digital currency system that had its value backed by gold stored in vaults in London and Dubai. Instead of using traditional currency units, E-gold was denominated in grams of gold. It provided a way to make online payments quickly and across borders. However, the project ran into serious legal and operational problems.

The E-gold system relied on a central server maintained by a single company. This setup had a significant weakness because if there were disputes among the operators or if authorities wanted to shut it down, the whole system could be disrupted. Initially, E-gold didn’t have strict restrictions on who could create accounts, which made it attractive for illegal activities. Although Jackson and his team tried to address these issues, they were found guilty of operating an unlicensed money transmission service, leading to the closure of E-gold.

Unlike eCash, which worked closely with traditional banks, E-gold operated as a separate financial system without approval or oversight from regulatory authorities. During this time, the U.S. government was concerned about public access to strong encryption and privacy tools on the internet. Projects like E-gold heightened these concerns regarding online transactions. The regulatory challenges and issues around alternative digital currencies that emerged during this period continue to be relevant today.

Hashcash

In 1992, IBM researchers Cynthia Dwork and Moni Naor were looking for ways to combat Sybil attacks, denial-of-service attacks, and spam on the growing internet, particularly in email services. They came up with a system described in their paper “Pricing via Processing or Combatting Junk Mail.” In this system, email senders would have to do some computational work to solve a cryptographic puzzle and attach the solution, known as a proof-of-work (PoW), to their emails. While the computational work was not very difficult, it was enough to deter spammers. This system also had a “trapdoor” that allowed a central authority to quickly solve the puzzle without doing the work.

In 1997, a 26-year-old University of Exeter graduate and active cypherpunk named Adam Back introduced a similar concept called Hashcash on the cypherpunk mailing list. Unlike the earlier system, Hashcash didn’t rely on a trapdoor, central authority, or complex cryptographic puzzles. Instead, it focused on a process called hashing.

Hashing is a way to convert any piece of data into a fixed-length random string of characters. Even a small change in the original data results in a completely different hash, making it useful for data verification. In Hashcash, the sender would repeatedly hash the email’s metadata, including sender and receiver addresses, message timestamp, and more, along with a random number called a “nonce.” They would keep hashing with different nonces until the resulting hash began with a specific number of zero bits.

Since the sender couldn’t predict the correct hash in advance, they had to put in computational effort by trying different nonces until they found a valid hash. This process generated a proof-of-work.

Adam Back had more than just anti-spam in mind for Hashcash, but the proof-of-work tokens it produced were not transferable or useful as digital currency for the recipient. Additionally, the currency’s value would have been affected by hyperinflation because faster computers could generate proofs more easily over time. However, Hashcash served as inspiration for two proposed digital cash systems and precursors to Bitcoin: B-money and Bit Gold.

B-money

In 1998, cypherpunk Wei Dai introduced B-money, a groundbreaking concept aimed at establishing a decentralized peer-to-peer financial system for online transactions, operating independently of traditional financial institutions and government regulations. B-money was designed to enable digital currency creation, enforce contracts, and resolve disputes through an arbitration system.

Dai’s first proposal involved replacing a central authority’s control with a shared ledger system among pseudonymous peers represented as public key addresses. To create digital currency, nodes had to solve computational problems (proof-of-work) in a multiphase auction. The number of issued assets depended on the computation’s cost relative to a standard basket of commodities. However, this initial proposal didn’t resolve the double-spending issue.

In his second proposal, Dai suggested a subset of peers, called “servers,” maintain the ledger, while regular users verified transactions processed by the servers. Servers deposited money in a special account, acting as collateral to prevent collusion and malicious behavior, similar to proof-of-stake systems in contemporary blockchains.

Although B-money was never implemented, it remarkably resembled Bitcoin in its use of a shared ledger and proof-of-work based digital currency. The key distinction was B-money’s tie to a commodity value, foreshadowing the concept of stablecoins in the modern cryptocurrency landscape. Despite its theoretical nature, B-money’s innovative ideas laid the foundation for future developments in the cryptocurrency space.

Bit Gold

In the realm of cryptocurrency development, Nick Szabo, an influential figure in the cypherpunk community, envisioned a digital currency system named Bit Gold in the late 1990s. Szabo, known for his expertise in various fields including computer science, cryptography, and law, sought to create a decentralized economic society outside the control of corporations and nation-states.

Szabo’s vision began with the concept of smart contracts in 1994, digital agreements executed and enforced through code, forming a basis for borderless e-commerce. Later, he identified a need for a native digital currency to facilitate these contracts. Observing previous digital cash attempts facing challenges, he developed Bit Gold, inspired by the historical concept of commodity money like gold bullion bits. Bit Gold aimed to be digital, scarce, costly to forge, and not reliant on trusted third parties.

Bit Gold functioned through an accumulating chain of hash-based proofs-of-work, similar to Hashcash and B-money. These proofs-of-work were timestamped and published to a network of servers. Issuance and ownership of Bit Gold were recorded on a distributed property title registry, managed by a quorum-based voting system.

However, Bit Gold faced a crucial issue: lack of fungibility. Each unit’s value was tied to the computational cost of the proof-of-work, causing disparities in value over time due to advancements in computational technology. Szabo proposed a second-layer solution involving a trusted bank to create stable units of Bit Gold, but this approach was vulnerable to Sybil attacks.

Szabo was on the brink of implementing Bit Gold when Satoshi Nakamoto published the design for Bitcoin in 2008. Recognizing Bitcoin’s innovative synthesis of past digital cash experiments, Szabo abandoned Bit Gold. Satoshi acknowledged the influence of both Wei Dai’s B-money proposal and Nick Szabo’s Bit Gold in the creation of Bitcoin, marking the crucial role these early concepts played in the invention of the world’s first successful cryptocurrency.

Napster

In 1999, Napster was established as the pioneer of peer-to-peer (P2P) file-sharing internet software with a primary focus on exchanging digital audio files, particularly music tracks. As its popularity grew, the company encountered legal challenges related to copyright violations.

While Bitcoin is not directly connected to Napster, it’s worth noting that Napster was the initial significant realization of a peer-to-peer network on a large scale. Today, Bitcoin holds the prominent position as the largest P2P application.

The Unfolding of Digital Currencies in the Realm of E-commerce

During this period, a surge of online retailers began experimenting with digital currencies. These can be likened to today’s credit card reward points, where consumers earn and redeem points.

One notable example was Beenz.com. It offered its users “beenz”, a digital currency, for activities such as visiting certain websites, making online purchases, or signing in through specific internet service providers. These earned “beenz” could then be used as a form of payment with online merchants that were part of the Beenz network. Another similar venture was Floorz. However, both these initiatives were short-lived.

These early attempts at digital currencies can be seen as precursors to today’s cryptocurrency boom. Yet, it’s worth noting that these were not cryptocurrencies, nor were they driven by blockchain enthusiasts. They were more akin to digital loyalty programs. Their brief lifespan could indicate that the market wasn’t ready for such innovations, or perhaps they were not implemented effectively enough to gain lasting traction.

BitTorrent

The turn of the 21st century ushered in a wave of significant technological discoveries, and it also marked the onset of critical vulnerabilities in the conventional financial world, exemplified by the Dot-Com bubble. As history unfolded, it became evident that Napster was just the beginning of a series of peer-to-peer (P2P) applications leading up to the emergence of Bitcoin.

BitTorrent, another pioneering creation, entered the scene, and it was the brainchild of a prominent figure in the cypherpunk movement. BitTorrent introduced a revolutionary communication protocol for P2P file sharing, enabling users to disseminate digital data across the Internet in a decentralized and distributed manner. Unlike traditional centralized systems, BitTorrent allowed individuals to share files directly with one another, collectively forming a network that bypassed the need for a central server.

This innovation marked a significant step forward in the evolution of P2P technology, showcasing the potential for decentralized systems in various applications. BitTorrent’s development and success highlighted the growing interest in peer-to-peer networks and laid the groundwork for the eventual rise of Bitcoin, which would further revolutionize how value and transactions were managed in the digital age.

Beenz e-currencies

In the late 1990s, a trend emerged in the online retail sector where various stores introduced digital currencies, akin to today’s credit card reward points, that customers could accrue and utilize for transactions.

One notable example was Beenz.com, a platform that rewarded users with “beenz” for actions such as visiting websites, making online purchases, or connecting through a specific internet service provider. These beenz e-currencies could subsequently be used for purchases with participating online retailers. A similar concept was embodied in Floorz. However, these digital currencies had a fleeting existence, fading almost as quickly as they appeared. They were primarily the result of non-crypto enthusiasts attempting to capitalize on the burgeoning trend.

These digital currency experiments were indicative of the internet’s early explorations into alternative forms of online value exchange, although they ultimately failed to gain the traction and sustainability that modern cryptocurrencies like Bitcoin have achieved.

Distributed Hash Table

Before technologies like Bitcoin and BitTorrent became widely known, there was something called a Distributed Hash Table or DHT, which played a crucial role in shaping these technologies. Think of DHT as a behind-the-scenes system that influenced how peer-to-peer networks like Napster, Gnutella, Freenet, and BitTorrent operated.

DHTs have some unique features that set them apart. They’re all about being independent and decentralized. In other words, there’s no big boss telling the system what to do. It’s like a community of nodes (computers) working together, with no central control.

One more important thing about DHTs is that they can handle problems really well. Even if some computers join, leave, or stop working, the system keeps on chugging without breaking down. It’s like having a sports team that doesn’t fall apart if a player gets injured or has to leave the game.

And lastly, DHTs are super scalable. They can work efficiently with a small group of nodes or a massive crowd of them, like thousands or even millions.

While DHTs are a fascinating part of the tech world, they’re quite different from blockchains. Blockchains are more about securely recording transactions, while DHTs are more about creating efficient, self-organizing networks. But in the grand scheme of things, DHTs were an important addition to the ever-evolving tech landscape.

BitTorrent

The turn of the 21st century ushered in a wave of significant technological discoveries, and it also marked the onset of critical vulnerabilities in the conventional financial world, exemplified by the Dot-Com bubble. As history unfolded, it became evident that Napster was just the beginning of a series of peer-to-peer (P2P) applications leading up to the emergence of Bitcoin.

BitTorrent, another pioneering creation, entered the scene, and it was the brainchild of a prominent figure in the cypherpunk movement. BitTorrent introduced a revolutionary communication protocol for P2P file sharing, enabling users to disseminate digital data across the Internet in a decentralized and distributed manner. Unlike traditional centralized systems, BitTorrent allowed individuals to share files directly with one another, collectively forming a network that bypassed the need for a central server.

This innovation marked a significant step forward in the evolution of P2P technology, showcasing the potential for decentralized systems in various applications. BitTorrent’s development and success highlighted the growing interest in peer-to-peer networks and laid the groundwork for the eventual rise of Bitcoin, which would further revolutionize how value and transactions were managed in the digital age.

PGP

In 2004, a guy named Hal Finney had a clever idea. He was working at a company called PGP, which was all about making online stuff super private. Hal’s big dream was to create a type of digital money, like the cash you have in your wallet but on the internet.

Now, making digital money is way trickier than it sounds. Imagine you have a digital coin, like a special picture on your computer. You could easily copy that picture and send it to as many friends as you want. But if you did that with digital money, it’d be like magic money that can be used over and over again. This is what people call the “double-spend problem” in the digital money world.

So, here’s where Hal’s Reusable Proof-of-Work, or RPOW, comes into the picture. He thought, “What if we have a super smart computer system, sort of like a VIP club list, that keeps track of who owns which digital coins?” This way, whenever someone tries to use the same coin more than once, the system would go, “Hey, that coin’s already been spent! No funny business allowed.”

RPOW was like a first draft, a test run, before Bitcoin became a big deal. It was trying to tackle the tough challenges of making digital money work smoothly and fairly for everyone.

So, in simple terms, RPOW was like a digital bouncer at the club, making sure no one sneaks in with counterfeit coins. It was a significant early step in the world of digital money and paved the way for the incredible innovation that is Bitcoin.

Ricardian Contract

The Ricardian Contract is a smart idea that came from a guy named Ian Grigg. He first thought of it in 1996, but the detailed paper on it came out in 2004. Imagine you’re making a deal, and you put it all in writing. Now, with a Ricardian contract, this written deal can also be read and understood by computers.

Here’s the cool part: this contract is written in a way that both humans and machines can understand. So, let’s say you and your friend want to make an agreement. With a Ricardian contract, you can write it down in a way that both of you can easily understand it, like a regular contract. But at the same time, a computer can also read it and follow the agreement’s terms automatically.

Think of it like a recipe that both a chef (a human) and a cooking robot (a machine) can use. The chef reads the recipe to understand and make the dish, while the robot scans it to do the same thing automatically. Similarly, a Ricardian contract lets both humans and computers work with the same agreement without any confusion. It’s a blend of traditional contracts and modern tech.

Liberty Reserve

Liberty Reserve was like a secret online money system that quickly gained a lot of users. At its peak, it had more than 1 million customers from all over the world, and they were making 12 million transactions every year. It was kind of like an online bank, but it didn’t ask many questions about who you were.

This service was based in Costa Rica and was running from 2006 to 2013. People liked it because it allowed them to send and receive money without revealing too much about themselves. It was almost like using a fake name to buy things online.

However, the good times didn’t last. In 2013, the police stepped in and closed down Liberty Reserve for good. They said it was involved in some shady stuff, like money laundering and other illegal activities. So, even though it was a popular way to move money secretly, it didn’t last long because it got into big trouble with the law.

The inception of Bitcoin

When the Great Recession hit, it was like a chain reaction of financial giants and banks collapsing one after another. The problems with the existing money system were laid bare for all to see. People worldwide were hit hard, as global currencies tumbled, and many lost their jobs.

In late 2008, an enigmatic individual named Satoshi Nakamoto introduced the Bitcoin White Paper to the world. Released on October 31, 2008, and titled “Bitcoin – A Peer-to-Peer Electronic Cash System,” this nine-page manifesto was shared with the cypherpunk mailing list in November 2008.

On January 3, 2009, Nakamoto successfully generated the Genesis Block, which marked the inception of the Bitcoin blockchain. The Genesis block was hardcoded into the Bitcoin software, and the 50 BTC it contained couldn’t be spent due to how the code was structured. The specific reasons for this remain unknown, adding to the enigma surrounding Satoshi’s story.

Although the average time between creating new blocks was expected to be 10 minutes, it took a full six days before the next block was added to the Bitcoin blockchain, as indicated by the timestamps on those blocks.

Several speculative theories attempt to explain this delay. Some suggest that Nakamoto used these extra days to mine the first block as a network test, while others propose a symbolic link to the biblical story of Genesis, where God created the world in six days.

Nonetheless, the first-ever Bitcoin transaction occurred on January 12, 2009, involving Nakamoto and the late Hal Finney, an early contributor to the project. Nakamoto sent Finney 10 BTC as a test, while Finney began mining blocks himself.

Ten months later, on October 5, 2009, the New Liberty Standard established the first Bitcoin-to-dollar exchange rate. At that time, $1 was equivalent to 2300.03 BTC.

Nakamoto poured their heart and soul into Bitcoin until 2010 and then vanished into obscurity.

Bitcoin has gone from being a passing trend to a really popular thing! But it’s not just about money; it’s a symbol of the hard work of tech enthusiasts and forward-thinking folks. We’re now in a new era where online money is becoming the main thing, like a kind of ‘Internet magic money.’

Naren is a finance graduate who is passionate about cryptocurrency and blockchain technology. He demonstrates his expertise in these subjects by writing for cryptoetf.in. Thanks to his finance background, he is able to write effectively about cryptocurrency.