- Introduction:

- The Five Key Problems of Centralized Financial Systems:

- The Origins of Modern Decentralized Finance:

- Ethereum and Decentralized Finance:

- Benefits of DeFi:

- Challenges of DeFi:

- What can you do with DeFi?

- Features of DeFi (Decentralized Finance):

- Features of CeFi (Centralized Finance):

- DeFi vs CeFi

- Conclusion

Introduction:

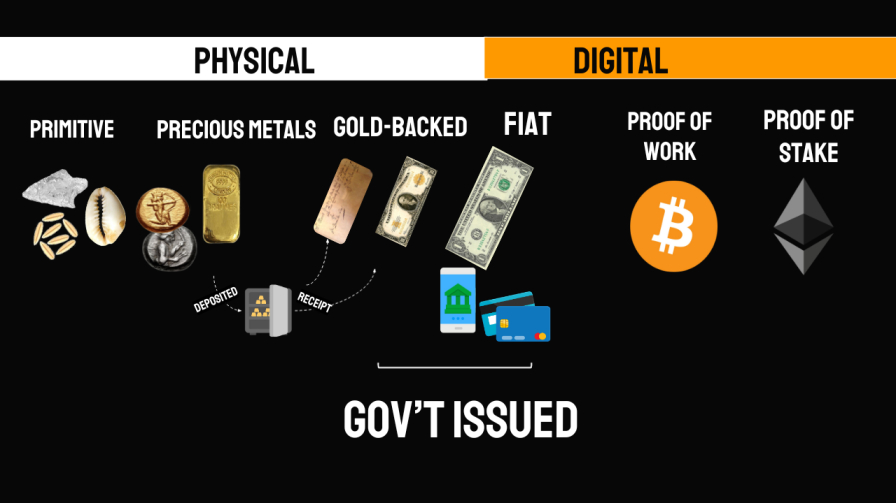

We’ve come full circle in the world of finance. The earliest form of trade was peer-to-peer barter, where goods were exchanged directly. However, this method was highly inefficient because it required a perfect match of supply and demand between trading partners. To solve this problem, money was introduced as a medium of exchange and a store of value. Initially, money took various forms and was not centralized. People accepted items like stones or shells as payment. Over time, tangible currency, known as specie money, emerged. Today, we have non-collateralized (fiat) currency controlled by central banks. While the forms of money have evolved, the fundamental infrastructure of financial institutions has remained largely unchanged.

However, there is now an emerging movement that has the potential to disrupt the current financial infrastructure dramatically. This movement is called Decentralized Finance or DeFi, which aims to create open-source financial tools using blockchain technology. DeFi aims to minimize friction and maximize value for users, and we believe it will eventually replace centralized financial systems. DeFi is all about inclusion, allowing anyone to access and benefit from these innovations by paying a flat fee.

DeFi is essentially a competitive marketplace of decentralized financial applications that serve as various financial “building blocks,” such as exchanges, savings platforms, lending platforms, and tokenization services. These applications leverage network effects and are gradually taking market share away from traditional financial institutions. In this article, we will explore the problems DeFi addresses, delve into the growing DeFi landscape, and envision the opportunities it unlocks for the future.

The Five Key Problems of Centralized Financial Systems:

For centuries, centralized finance has been the norm. Central banks control the money supply, financial trading is intermediated, and borrowing and lending happen through traditional banks. However, DeFi has the potential to solve five major problems associated with centralized finance:

Centralized Control: Centralization exists at multiple levels in the financial system. Most consumers and businesses deal with a single, localized bank, which controls interest rates and fees. Switching banks can be costly. In the United States, the banking system is highly concentrated, with four major banks holding a significant share of insured deposits. This centralization extends to other sectors, such as tech giants dominating various industries.

Limited Access: Approximately 1.7 billion people worldwide are unbanked, making it challenging for them to access loans and participate in online commerce. Even for those with access to banking services, certain financial needs may not be met efficiently. Banks might not provide small loans to new businesses, pushing them toward high-interest credit card loans.

Inefficiency: Centralized financial systems suffer from various inefficiencies. For example, credit card interchange rates lead to consumers and small businesses losing a significant portion of a transaction’s value due to high fees. Remittance fees can be as high as 5-7%. Settlement times for stock transactions can be unreasonably slow, taking two days in the internet age. Other inefficiencies include slow fund transfers, brokerage fees, and security issues.

Lack of Interoperability: Traditional financial institutions operate in silos, making it challenging to move money between institutions. Wire transfers can take days to complete, adding unnecessary delays. Interconnectivity in the financial system is limited, and switching between providers can be cumbersome.

Opacity: The current financial system lacks transparency. Bank customers have little information about their bank’s financial health and must rely on government protection like FDIC insurance. Customers seeking loans struggle to determine if the offered rate is competitive, leading to a fragmented loan market with hidden costs.

These problems have significant economic and social implications, including hindering economic growth and perpetuating inequality. DeFi aims to address these issues by introducing decentralized, transparent, and open financial solutions.

The Origins of Modern Decentralized Finance:

To understand the evolution of DeFi, we need to take a brief look at the history of finance. The earliest forms of trade were peer-to-peer barter systems, where goods were exchanged directly. Over time, coins were introduced as a medium of exchange, followed by banknotes. Non-physical transfers of money emerged with innovations like Western Union.

However, the financial system remained centralized, and costs continued to be a concern. Fintech innovations started addressing these inefficiencies. For example, PayPal, founded over 20 years ago, offered a digital payment solution. Dark pool stock trading was another innovation that reduced costs by allowing large institutions to trade directly.

The breakthrough in the world of cryptocurrencies came with the introduction of Bitcoin by an anonymous figure known as Satoshi Nakamoto in a 2008 white paper. Bitcoin combined blockchain technology with a consensus mechanism called Proof of Work, creating a decentralized, immutable ledger. This innovation offered the key features of a store of value, including scarcity, censorship resistance, and user sovereignty.

Bitcoin’s value proposition lies in its scarcity, self-sovereignty, and portability. While it was initially conceived as a peer-to-peer currency, its deflationary characteristics and flat transaction fees make it more suitable as a store of value over the long term. Bitcoin is often viewed as a potential hedge against economic and political instability.

Ethereum and Decentralized Finance:

Ethereum, introduced by Vitalik Buterin in 2014, marked the next step in the evolution of cryptocurrencies. Ethereum is a smart contract platform that allows developers to create decentralized applications (dApps) on its blockchain. Smart contracts are self-executing contracts with the terms directly written into code, eliminating the need for intermediaries.

The emergence of Ethereum led to the rise of decentralized applications, particularly in the financial sector. These financial dApps removed the need for centralized clearinghouses and intermediaries, creating a movement known as decentralized finance or DeFi. DeFi aims to minimize friction in financial transactions and maximize value for users by leveraging blockchain technology.

DeFi is essentially a competitive marketplace of financial dApps that serve as building blocks for various financial services. These dApps benefit from network effects as they attract more users from traditional financial systems. DeFi’s goal is to replace centralized financial infrastructure gradually.

Benefits of DeFi:

- Decentralization: DeFi operates in a decentralized manner, reducing the risks associated with centralized finance (CeFi). In CeFi, exchange failures can lead to catastrophic losses, whereas DeFi is less vulnerable to such failures.

- Permissionless: DeFi is permissionless, meaning users don’t require approval from a central authority to make transactions. Smart contracts define the possibilities, fostering openness and inclusivity.

- Transparency: DeFi’s smart contract model ensures transparent transaction terms and logic without hidden code, enhancing trust and clarity.

- Anonymity: While smart contracts are transparent on the blockchain, DeFi doesn’t mandate user identification. Know Your Client (KYC) requirements common in centralized systems aren’t necessary.

- Custody: DeFi empowers users with control over their assets. Users retain custody of their cryptographic private keys for cryptocurrency tokens.

- DApps: DeFi supports decentralized applications (DApps) that extend beyond finance, offering users access to various services like gaming and social media, broadening its utility.

- Lower Fees: DeFi typically incurs lower fees than transactions in centralized finance, as there’s no central authority.

Challenges of DeFi:

- Complexity: DeFi can seem complex, especially for newcomers. Its peer-to-peer (P2P) nature, reliance on smart contracts, and intricate algorithms can be challenging to grasp fully, leading to confusion.

- Customer Service: DeFi lacks a centralized customer service point, making it difficult for users to seek assistance when they encounter issues or have questions.

- Volatility: DeFi can exhibit more volatility since there’s no central authority to moderate or control transaction and market dynamics. This can pose risks for users.

- Security: DeFi platforms have increasingly become targets for cyberattacks. In August 2022, the FBI issued an alert highlighting that over $1 billion in assets had been stolen from DeFi platforms in just three months, underscoring the security challenges it faces.

What can you do with DeFi?

DeFi opens up a world of financial possibilities that were traditionally offered by banks and financial institutions, but it does so in a peer-to-peer manner, without the need for a central authority. Here are some of the things you can do with DeFi:

- Global Payments: DeFi allows you to make cross-border payments easily and quickly, without relying on traditional banking systems. You can send funds to anyone, anywhere in the world, with reduced fees and delays.

- Trading: You can engage in trading various cryptocurrencies and digital assets on decentralized exchanges (DEXs). These exchanges operate through smart contracts and allow you to trade directly with other users, giving you more control over your assets.

- Borrowing: DeFi offers a streamlined way to access loans. Instead of a lengthy process involving banks and credit checks, you can visit a DeFi DApp, use your crypto as collateral, and instantly borrow funds. Other users in the DeFi ecosystem provide these loans and earn interest in return.

- Lending: If you have excess crypto assets, you can lend them out to earn interest. DeFi platforms connect you with borrowers looking for funds, allowing you to earn a passive income by providing liquidity to the ecosystem.

- Derivatives: DeFi also supports the creation and trading of financial derivatives. These can include options, futures, and other complex financial instruments, all executed through smart contracts.

Features of DeFi (Decentralized Finance):

- Permissionless: DeFi operates on blockchain networks that are open to anyone, anywhere, without requiring approval or acceptance. This accessibility fosters community interactions and inclusion.

- Trustless: DeFi’s strength lies in its trustlessness. Users can audit the code and utilize tools like Etherscan to verify transaction completion, ensuring the efficiency of DeFi services without relying on intermediaries.

- Continued Innovation: The DeFi ecosystem is characterized by ongoing innovation. It continually develops new capabilities and tests novel financial services, making it a dynamic and evolving space for users.

Features of CeFi (Centralized Finance):

- Seamless Customer Support: Centralized Exchanges (CEXs) typically provide internal accounts for managing user funds. Large CeFi companies also prioritize user data security and offer dedicated customer support teams, enhancing trust and providing assistance to customers.

- Flexible Conversion: CeFi platforms facilitate the conversion of fiat currency into cryptocurrencies with ease. This user-friendly approach often leads to higher customer onboarding rates. For instance, Coinbase boasts 89 million global users due to its streamlined conversion process.

- Interoperability: CeFi platforms enable seamless lending, trading, borrowing, and payment services by using funds held in custody across multiple blockchain networks.

- Services for Cross-Chain Swaps: Centralized finance excels in facilitating the trading of cryptocurrencies from various independent blockchain platforms. Unlike DeFi, which can encounter complexities and delays in cross-chain swaps, CeFi efficiently manages assets from multiple chains.

- Centralized Exchange (CEX): Using a centralized exchange, users can manage their portfolios through internal accounts, avoiding blockchain transaction fees. The exchange’s custodial nature means users don’t have to worry about the intricacies of asset management.

DeFi vs CeFi

| Particulae | DeFi | CeFi |

|---|---|---|

| Services | Borrowing, Lending, Trading, Payments | Payments, Lending, Trading, Borrowing, Fiat-to-crypto |

| Public Verification | Execution should be publicly verifiable | Not mandatory to verify publicly |

| Atomicity Element | Present | Not present |

| Anonymous Development | More anonymity | Less anonymity |

| Custody | Gives customers complete control over assets | Acts as custodians |

| Malleability of Execution Order | Multiple market manipulation tactics possible | Stringent regulatory requirement leaving no scope for market manipulation |

| Transaction Cost | Charges transaction fee | Offers transactions at no extra cost |

| Cross-chain Services | Delay in completing cross-chain exchange | Majority of cryptocurrencies are traded frequently |

| Fiat Conversion Flexibility | No fiat conversion flexibility | Fiat currency is involved for exchange |

| Security | More secure | Less secure |

Conclusion

DeFi represents a paradigm shift in the world of finance. It addresses the shortcomings of centralized financial systems by offering decentralized, transparent, and inclusive solutions. While challenges exist, the potential benefits of DeFi are vast, and its growth could reshape the financial landscape in the years to come. As DeFi continues to evolve, it will be exciting to witness the winners and losers in this transformative journey.

Naren is a finance graduate who is passionate about cryptocurrency and blockchain technology. He demonstrates his expertise in these subjects by writing for cryptoetf.in. Thanks to his finance background, he is able to write effectively about cryptocurrency.