History of Bitcoin ETF progress:

- July 2013: The Winklevoss Bitcoin Trust filed the first proposal for a Bitcoin ETF.

- June 2018: The SEC rejected the Winklevoss’ second Bitcoin ETF proposal.

- October 2019: Bitwise’s Bitcoin ETF proposal was rejected by the SEC.

- February 2020: The SEC rejected Wilshire Phoenix’s Bitcoin ETF project.

- September 2020: The world’s first Bitcoin ETF was listed on the Bermuda Stock Exchange.

- December 2020: VanEck filed a new proposal for a Bitcoin ETF after withdrawing previous proposals multiple times.

- February 2021: Canada launched its first Bitcoin ETF, the Purpose Bitcoin ETF (BTCC), followed by the approval of two more in the same month: the Evolve Bitcoin ETF (EBIT) and the CI Galaxy Bitcoin ETF (BTCX).

- October 2021: The first U.S.-listed Bitcoin ETF, the ProShares Bitcoin Strategy ETF (BITO), was launched.

- June 2023: The SEC approved the 2x Bitcoin Strategy ETF (BITX) from Volatility Shares and the First Leveraged Bitcoin Futures ETF.

- On June 15, BlackRock filed for SEC approval of a spot Bitcoin ETF. This filing marked a significant development in the effort to launch a spot-traded Bitcoin ETF in the United States.

- August 2023: London-based Jacobi Asset Management launched Europe’s first Bitcoin ETF.

- August 2023: Grayscale won an appeal against the SEC, allowing it to convert its Bitcoin Trust into an ETF.

The race to launch the first spot-traded Bitcoin (BTC) exchange-traded fund (ETF) in the United States has attracted major financial institutions like BlackRock, Fidelity, and VanEck. The U.S. Securities and Exchange Commission (SEC) initially approved a Bitcoin-linked Futures ETF in October 2021, but the current filings are for spot Bitcoin ETFs. After Grayscale’s recent legal victory against the SEC’s review of its spot Bitcoin ETF proposal, many believe the chances of approval for such investment funds have improved.

BlackRock, the world’s largest asset manager, filed for a spot Bitcoin ETF in June, partnering with Coinbase for crypto custody and spot market data and BNY Mellon as its cash custodian. This move surprised many, as BlackRock’s CEO, Larry Fink, had previously been critical of BTC. The SEC formally accepted BlackRock’s application for review on July 15.

WisdomTree, a New York-based asset manager, filed for a spot Bitcoin ETF in December 2021 but faced SEC rejection in 2022 due to concerns about investor protection. Following BlackRock’s entry, WisdomTree refiled its application in July 2023.

Valkyrie Investments filed its first spot Bitcoin ETF application in January 2021, facing rejection from the SEC. However, the renewed interest in spot Bitcoin ETFs led Valkyrie to refile its application in June 2023, with plans to use the Chicago Mercantile Exchange’s reference price for Bitcoin and trade on NYSE Arca with Xapo as the crypto custodian.

ARK Invest filed an application for its ARK 21Shares Bitcoin ETF in June 2021, partnering with Swiss-based ETF provider 21Shares. If approved, this ETF will launch on the Chicago Board Options Exchange (Cboe) BZX Exchange under the ticker symbol ARKB.

VanEck, one of the earliest Bitcoin ETF applicants, made its first filing in 2018 but withdrew the application in 2019. The firm attempted again in December 2020, planning to trade on the Cboe BZX Exchange. In July 2023, VanEck filed a new application.

Fidelity Investments applied for a spot Bitcoin ETF in 2021 and refiled for the Wise Origin Bitcoin Trust in July 2023. Fidelity Service Company will serve as the administrator, while Fidelity Digital Assets will be the BTC custodian.

Invesco Galaxy Bitcoin ETF initially filed an application in September 2021, jointly with Galaxy Digital. The joint venture refiled its application in July, planning for a “physically backed” Bitcoin ETF with Invesco Capital Management as the sponsor.

Bitwise first filed for a spot Bitcoin ETF in October 2021 but was rejected by the SEC. The asset manager refiled its application in August 2023.

GlobalX Fund manager GlobalX entered the ETF race in 2021, filing for a spot Bitcoin ETF, and refiled its application in August 2023, making it the ninth applicant. Coinbase was named as its surveillance-sharing partner.

Why did the SEC previously reject spot Bitcoin ETFs?

The SEC rejected VanEck’s spot Bitcoin ETF earlier, citing concerns about the Bitcoin market’s size and maturity, its price volatility, and the level of trading surveillance, which could make it susceptible to fraud and manipulation. However, the entry of BlackRock has led many to believe that the chances of a spot Bitcoin ETF being approved have improved.

One key factor hindering the approval of a spot ETF is its unique nature compared to futures ETFs. Futures ETFs are based on futures contracts rather than the actual digital asset, and the futures market is already heavily regulated to prevent manipulation, making it easier for the SEC to approve them.

The rejection of spot Bitcoin ETFs revolves around the requirement for issuers to establish a “surveillance-sharing agreement” with a large and regulated Bitcoin-related market. Such agreements are crucial for enabling thorough investigations in case of market irregularities.

One of the main concerns behind the rejection of spot Bitcoin ETFs is the regulator’s ability to ensure the safety and custody of assets continuously. This would require more regulatory and legal infrastructure in the U.S. for the SEC and other parties to feel comfortable allowing ETF providers to handle it.

While the SEC oversees futures exchanges like the CME and the Cboe, there are no SEC-regulated spot exchanges, which adds to their concerns about the spot crypto ETF market’s robustness.

However, not everyone agrees with the SEC’s assumptions about the vulnerabilities of spot crypto ETFs. Some argue that crypto futures are less reliable in terms of tracking errors and that expecting a U.S. regulator to adequately monitor a global cryptocurrency market is unrealistic.

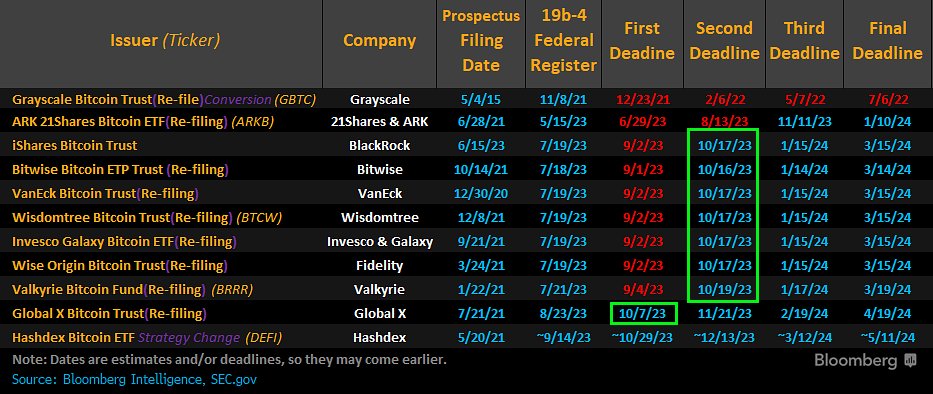

NEXT DATES TO WATCH:

The middle of October, especially October 16th, is an important date to pay attention to regarding spot Bitcoin ETFs. It’s also worth noting that @GlobalXETFs has something related to these ETFs on October 7th.

And, as a reminder, it’s not surprising that there are delays in approving these ETFs. Approving them this week would have been unexpected because the regulatory process for these investments is quite complex and takes time.

Why the need for a Bitcoin ETF?

For most regular investors, Bitcoin and cryptocurrencies can seem risky. They’re not regulated very clearly, and owning Bitcoin involves dealing with things like Bitcoin wallets and crypto exchanges, which can be unfamiliar and require some learning.

When you own Bitcoin, you’re responsible for its security. You have to keep your private keys safe (unless you trust an exchange to do it for you). This might mean buying a special hardware wallet to protect your Bitcoin or finding a secure way to store your private keys. Plus, you’ll need to figure out how to report your Bitcoin sales for taxes, especially if you make a profit.

That’s where a Bitcoin ETF comes in. With it, you don’t have to worry about private keys, storage, or security. You simply buy shares of the ETF, just like you would with regular stocks. It’s an easy way to invest in Bitcoin without dealing with all the complexities of buying and holding actual Bitcoin.

In simple terms, a Bitcoin ETF is a very attractive option for both regular people and big investors because it makes investing in Bitcoin much simpler. That’s why many investment firms have applied to create Bitcoin ETFs, but so far, none have been approved by the SEC.

How does a Bitcoin ETF work?

A Bitcoin ETF works like this: a company buys and holds actual Bitcoin, and the value of the ETF is tied to the amount of Bitcoin they hold. They then list this ETF on a regular stock exchange. As an investor, you can buy and sell this ETF just like you would with any other stock. This also means you can do things like bet against Bitcoin if you want.

But there are some important differences between a Bitcoin ETF and other ETFs:

First, some ETFs are made up of stocks from companies, like those in the S&P 500. If you own shares in an ETF with these stocks, you get a share of any dividends those companies pay to their shareholders. However, because Bitcoin is decentralized and not a company, you won’t get dividends from a Bitcoin ETF.

Second, like with all ETFs, you have to pay fees to the company that manages the ETF. But with a Bitcoin ETF, a part of these fees goes toward covering the costs of buying and safely storing the actual Bitcoin that the ETF represents.

In simple terms, a Bitcoin ETF lets you invest in Bitcoin through a stock-like investment, but you won’t get dividends from it like you might with other ETFs. Plus, there are fees to consider, some of which cover the costs of dealing with real Bitcoin.

In summary

The race for a spot-traded Bitcoin ETF in the U.S. continues, with major players vying for approval. The SEC’s concerns about the market’s maturity, volatility, and surveillance are still obstacles, but the entry of institutional giants like BlackRock has raised hopes for approval. Additionally, the likelihood of an Ether futures-derived ETF gaining approval appears to be high, which could further legitimize cryptocurrencies as an asset class.

Naren is a finance graduate who is passionate about cryptocurrency and blockchain technology. He demonstrates his expertise in these subjects by writing for cryptoetf.in. Thanks to his finance background, he is able to write effectively about cryptocurrency.